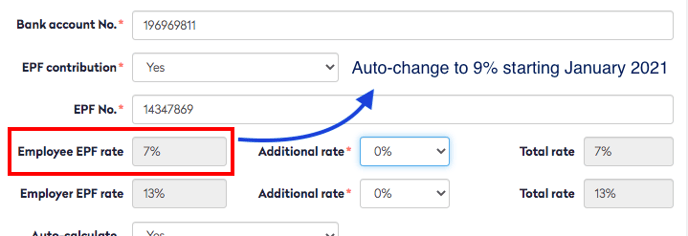

New employee EPF rate for the year 2021

From the latest 2021 budget, the government has announced that the new rate for employee contribution is reduced to 9% from 11%. The contribution rate is effective from January 2021 until December 2021.

The new statutory contribution rate for employees applies to those below 60 years of age, who are liable for contribution. However, the statutory contribution rate for employees aged 60 years old and above remains unchanged.

What should I do about this change?

As an employer, you have two options:

Option 1 - Employees who choose to follow the new minimum contribution rate of 9%

- Swingvy will adjust the employee default contribution rate to 9% from Jan 2021 to Dec 2021 payroll.

- Just process the payroll as usual.

Option 2 - Employees who choose to maintain the current employee contribution rate of 11%

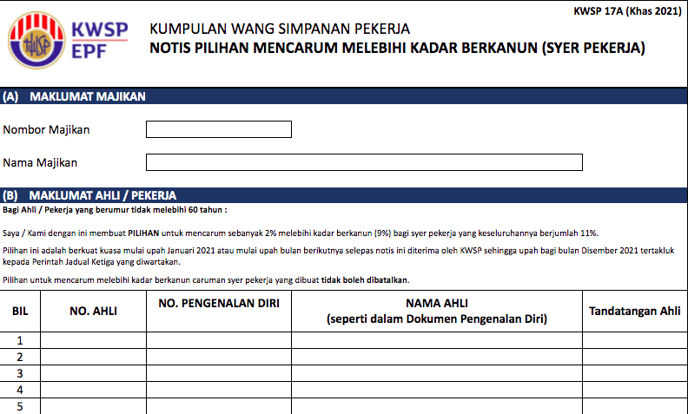

- For those employees who wish to retain their contribution at 11%, HR will fill up the employee information in Form 17a Khas and submit it to KWSP.

- Download the form from KWSP on the Syer Pekerja (the excel file will auto-download).

- Fill up the form.

- Update it in the KWSP employer i-Account.

- Then, update the EPF rates in Swingvy

Update EPF rates in Swingvy

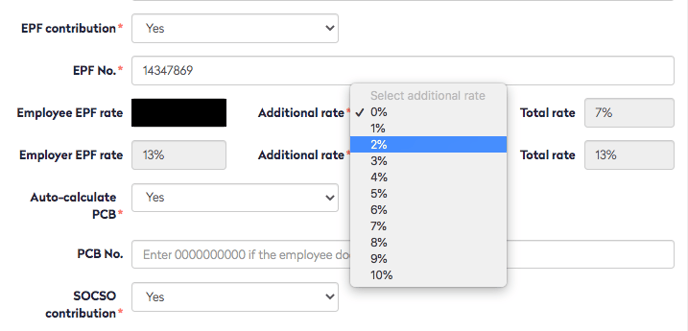

(a) Individual update

- Select Payroll > Go to the payroll employee profile

- Update 2% on employee EPF additional rate

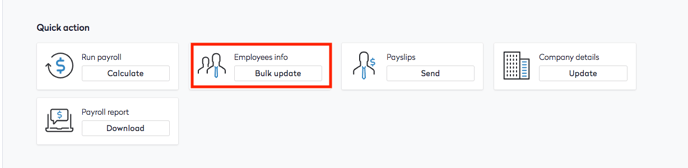

(b) Bulk update

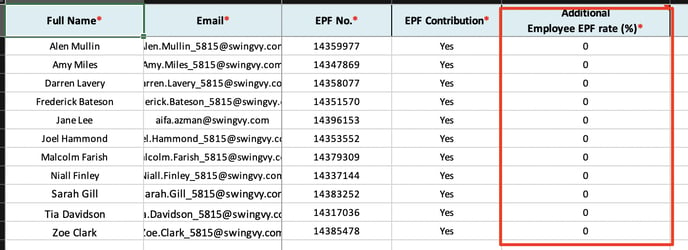

- Go to Payroll (Home ) > Click Employees info (Bulk update) > Download payroll bulk upload template

- Update 2% under additional employee EPF rate column for employees who choose to maintain the contribution rate of 11%

- Upload to Swingvy

Note:

For any employees who previously had an additional 4% EPF rate on top of the 7% contribution, Swingvy will zeroise the amount and it will appear as 9% in January 2021. This is to avoid any dispute as some employees might want to keep it at 9%. Plus, the admin will need to submit a new form to KWSP on the changes for the 11% contribution. Please update the new additional rates of 2% should the employee decide to stay at 11% contribution rate.