Deduct unpaid leave through Swingvy payroll

No more manual calculations! When running payroll, the Payroll admin can now import the number of approved Unpaid leave from the Leave module for payroll deduction.

Here are the steps for you to import the approved unpaid leave to payroll:

Step 1 - Go to 'Payroll' > 'Run payroll' and choose the desired payroll month

Step 2 - Click on 'Import' > Import unpaid leave from Leave

Step 3 - Select the approved unpaid leave date range that needs to be submitted

Step 4 - Select the employees' name

Step 5 - Click on 'Import'

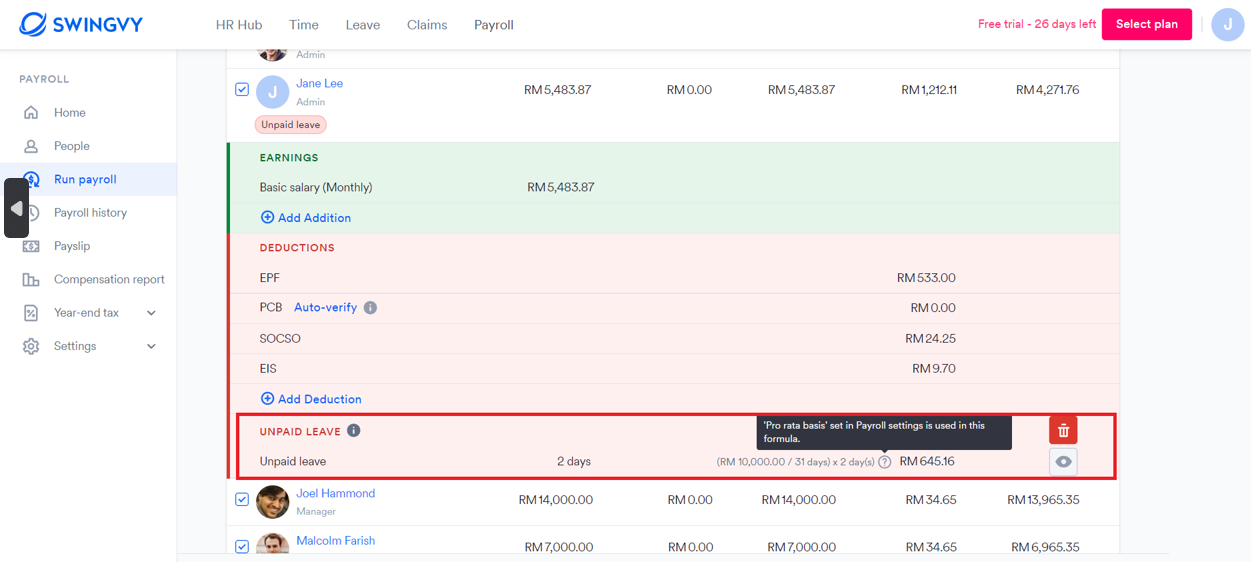

Step 6 - You can confirm the amount and formula calculated by the system under the deduction column.

- Unpaid leave: (Monthly salary / Pro rata basis) x n day(s)

👉Pro-rata basis configured under Payroll > Settings > Payroll settings > Pro rata settings

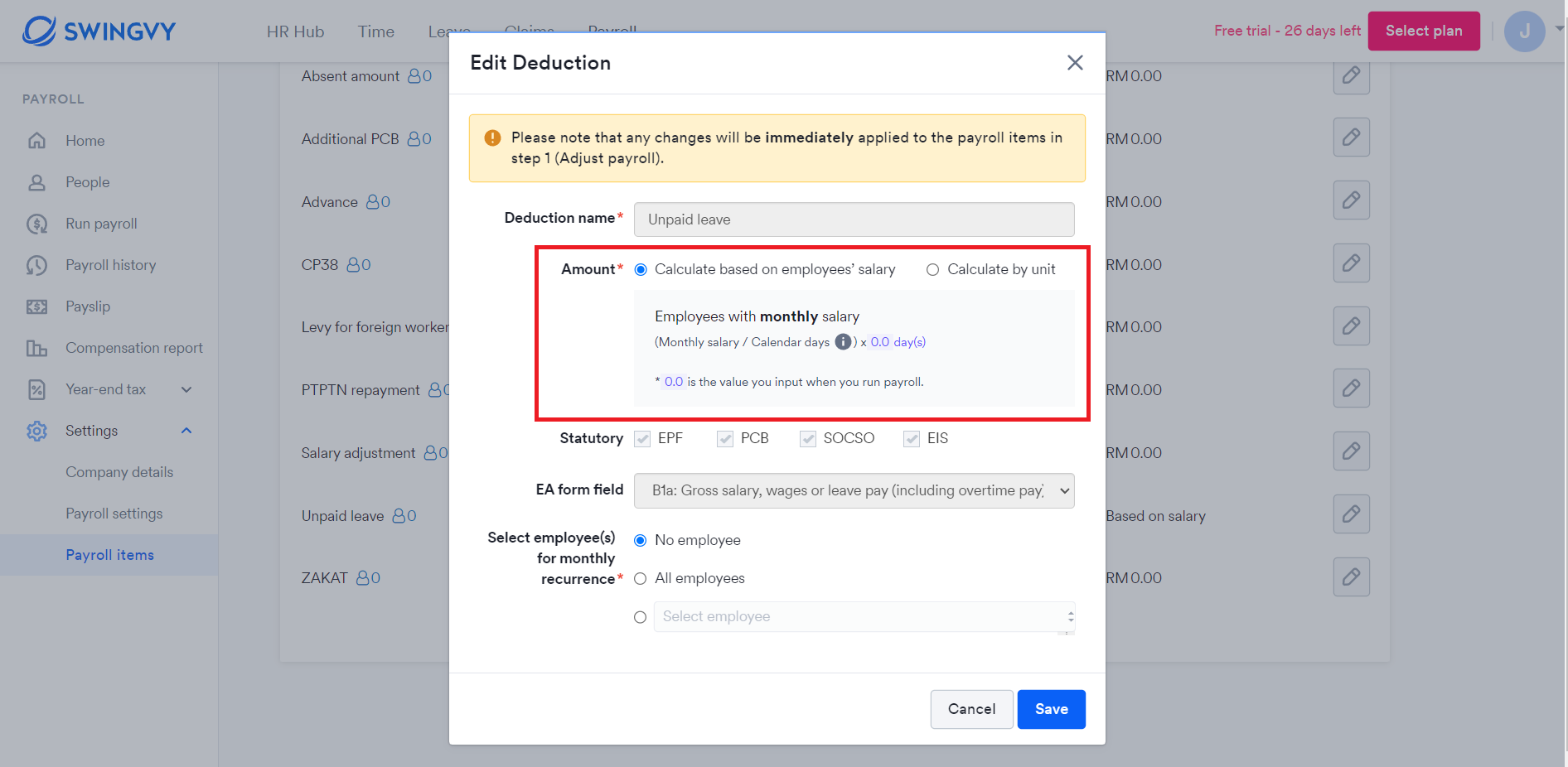

- Unpaid leave’ deduction item’s Edit dialog shows how unpaid leave is calculated

There are multiple cases resulting in unpaid leave being unavailable to be imported:

- The employee is not included in the payroll

- The employee requested hourly leave request for unpaid leave but they belong to a workgroup in which the working hour is not 8 hours (This is due to the system limitation that Leave module assumes that the working hour is always 8 hours)

- The leave deduction item is configured to “Calculate by unit” not “Calculate based on employees' salary” in the Payroll item settings

Notes:

1. Only approved 'Unpaid leave' in Swingvy Leave will be imported for payroll deduction.

2. Unpaid leave should be set as ‘Calculate based on employees’ salary’ in the Deduction item setting.