Fill out company information

Company details

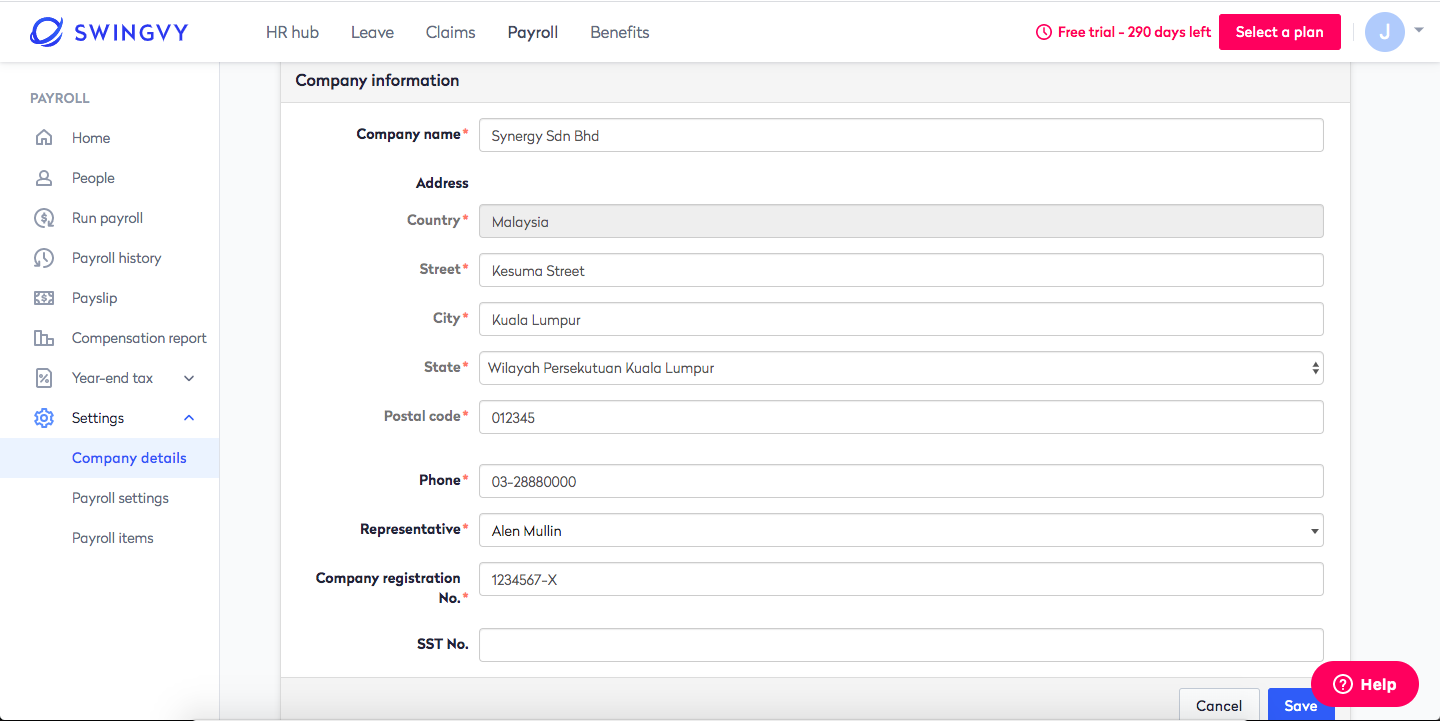

From the settings, select company details, click on Edit at the company information

On this page, you can set up the following information:

-

Company name (To be used in payslip and statutory reports)

-

Company Address (To be used in payslip and statutory reports)

-

Company Phone Number

-

Representative (The representative name will appear as the representative in the EA form)

-

Company Registration Number (To be used in payslip and statutory reports)

-

SST - Service Tax (Not Compulsory)

What is Service Tax?

-

Service tax is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business.

-

A taxable person is any person who belongs in Malaysia and is prescribed to be a taxable person.

-

Taxable service is any service prescribed to be a taxable service.

-

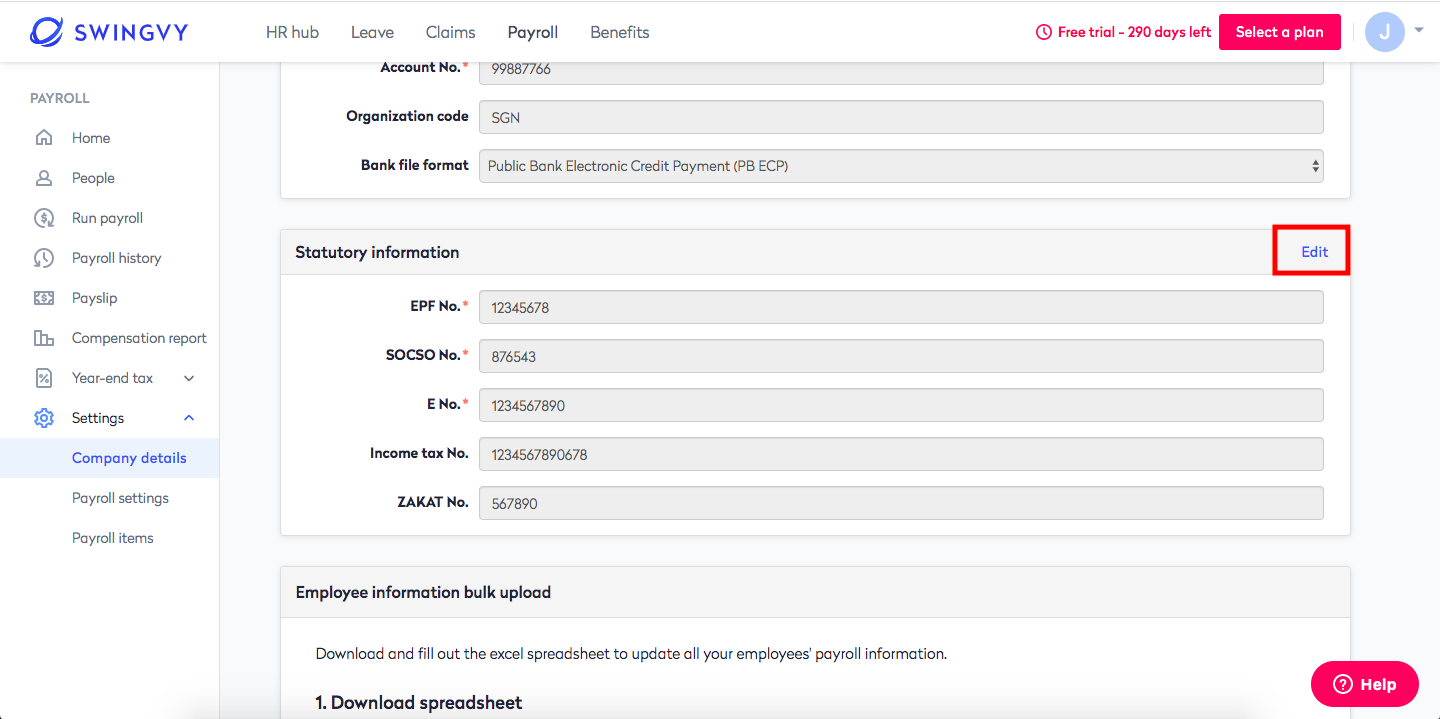

Statutory Information

Company statutory information (the numbers can be obtained from each statutory body upon the employer registration, this information is needed for monthly statutory file/report generation):

Note:

What is E Number?

E number is the employer number and it will be captured in the monthly PCB submission file(CP39) and EA form. The E number can be found from Form E LHDN