How to amend submitted IR8A forms via AIS

Amendment of Appendix 8A and Appendix 8B are not supported in Swingvy. If the amendment for the appendices (Appendix 8A/8B) affects the figures submitted for Form IR8A, an IR8A amendment file must be submitted as well via myTax Portal.

Amend IR8A and submit directly to IRAS under Auto-Inclusion Scheme (AIS)

You have already submitted IR8A and realize you have made a mistake or missed certain items to fill in for employee(s)?

Worry not, amending the IR8A forms is easy on Swingvy. Here is a step-by-step guide on how you can make the amendment.

Step 1 - Head over to Payroll > Year-end tax

Step 2 - Click on 'Modify submitted file'

Step 3 - Choose revision method between Revision and Amendment

- Revision - To override previously reported employee records (Recommended)

- Amendment - To report income/deductions differences to previously reported employee records

Step 4 - Choose the employee(s) to revise details for.

Note:

- Only those included in the Original tax file in 'Submitted' status will appear on the employee list.

- The original file can be submitted only once per employee, but the Amendment/Revision file can be submitted multiple times, and all amendment/revision records will be accumulated.

- The employee's personal particulars (e.g. address, date of birth, name of fund) cannot be edited during amendment. To correct this info, email the correct details through myTaxMail. (Select Businesses > Employers > Auto-Inclusion Scheme (AIS))

- Learn more in the amendment guide.

Step 5 - Revise the needed details

The data entry process depends on whether you chose Revision or Amendment in Step 3.

If you chose Revision method,

- Initial values for IR8A form are retrieved from the previously submitted file.

- Enter the full and correct amounts for all required fields.

If you chose Amendment method,

- Prepare and submit only the difference in the amount(s) between the income reported to IRAS and the actual income the affected employee(s) earned.

- Enter a negative amount if you have over-declared in the original file.

- Leave all other numeric fields not affected by the error, blank.

Submitted Salary (under declared) = $24,000 Difference = $4,000 You should submit: 1 Amendment Record with the amount at Salary field = $4,000 |

Actual Bonus = $5,000

|

Step 6 - Click on "Save"

Step 7 - Re-enter organisation details by clicking Edit organisation info

![]()

Step 8 - Click on 'Proceed'

Step 9 - Validate your IRAS > Click on 'Submit to IRAS' – There is a security authentication before submitting to IRAS.

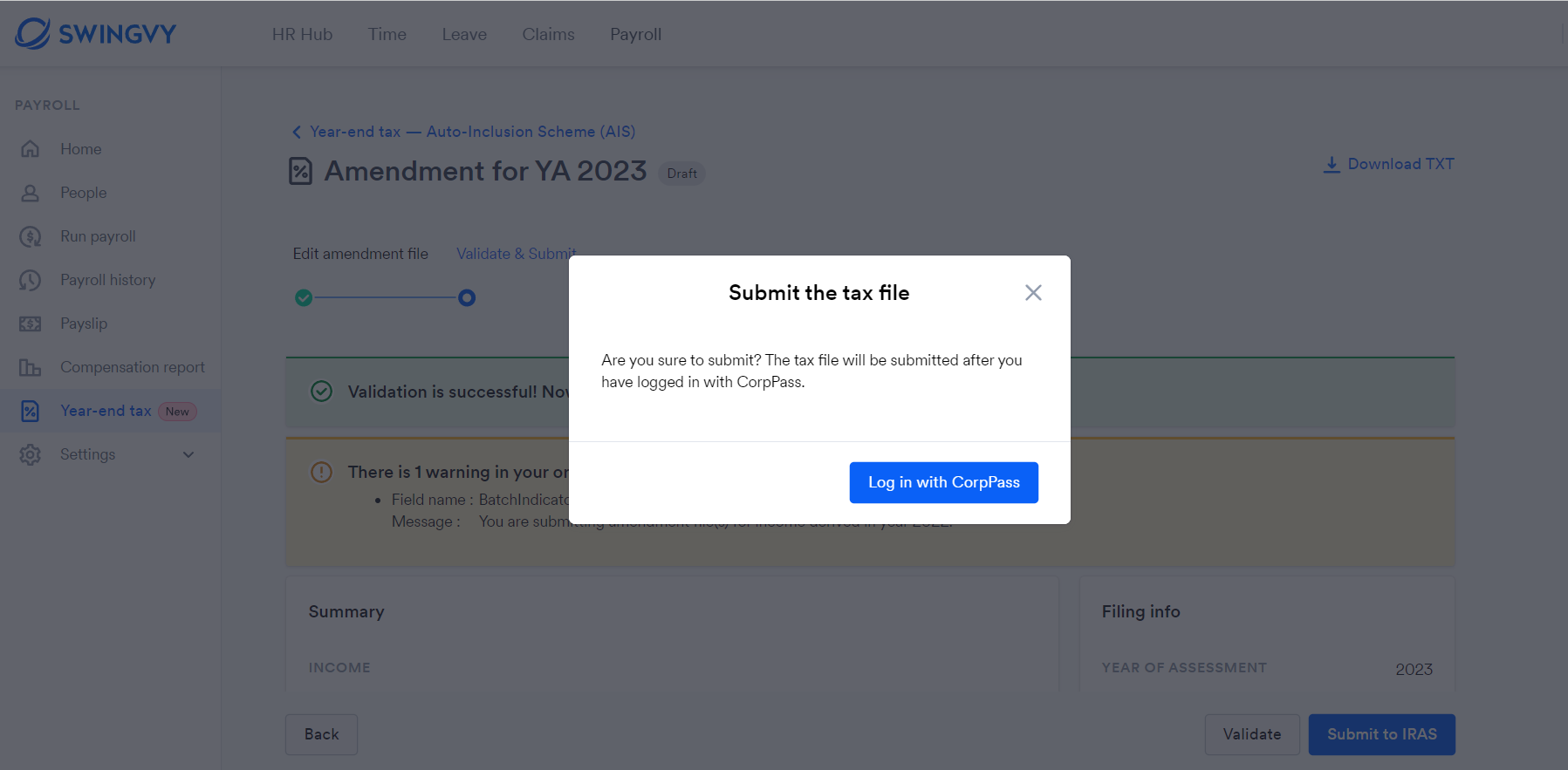

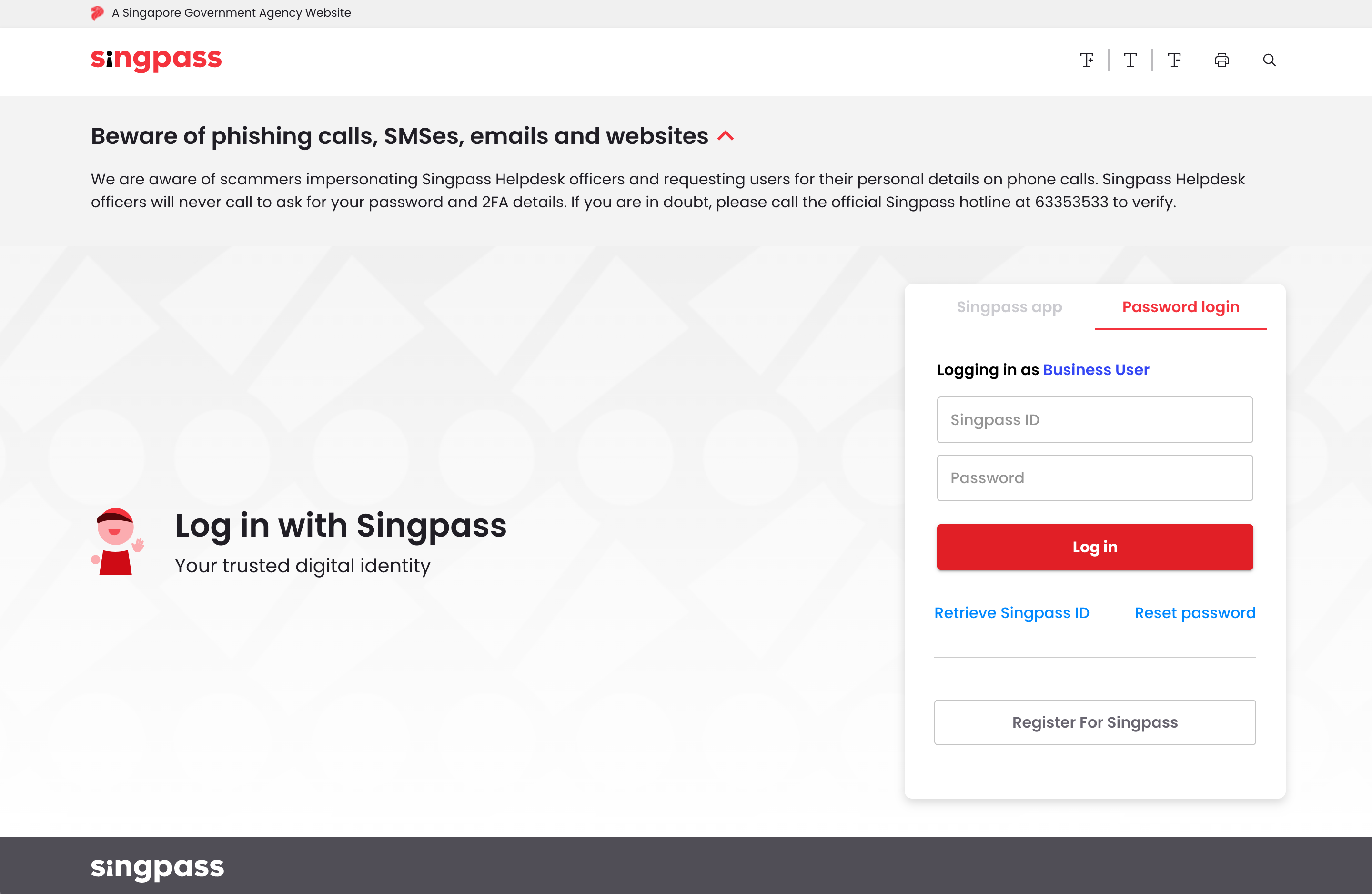

Step 10 - After clicking the submit button, there will be a message box to log in with CorpPass

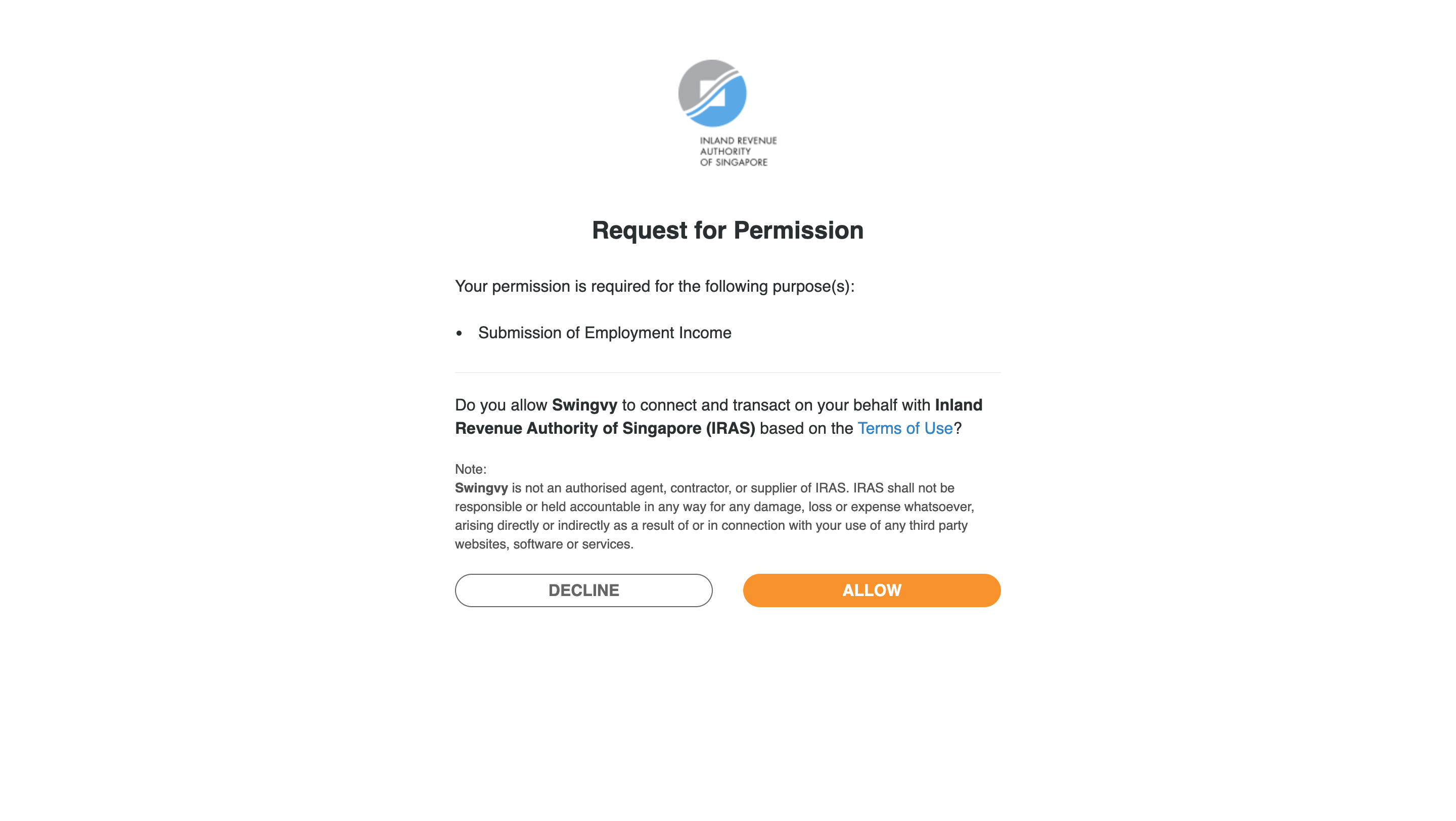

Step 11: Once you log in to CorpPass, you need to provide permission. Swingvy is able to submit tax filings/IR8A amendments only after permission is granted.