How to revert a payroll

Reversing payroll is crucial for admin as sometimes payroll needs to be amended at the very last minute. In Swingvy, payrolls can be reverted from your end with limitations to keep your payroll calculation accurate. Reverting a payroll is available at the below stages:

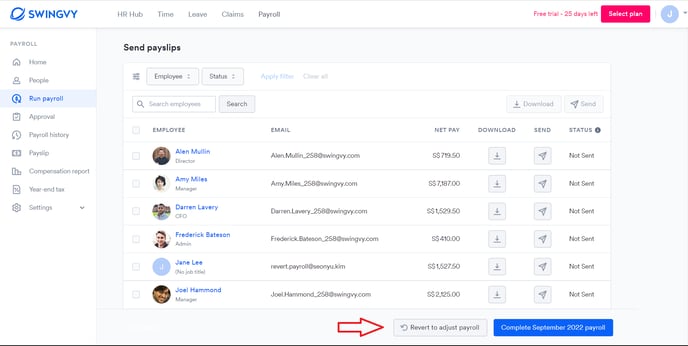

1. Payroll at Step 3- Pay & Submit from the Run payroll menu

2. Completed payroll from the Payroll history menu

To successfully revert the current month's payroll, it is essential that any future month payroll is positioned at step 1. For instance, if you intend to revert the July payroll, ensure that the August pay run is at step 1.

Here are scenarios and steps for you to revert payroll.

Scenario 1:

You have mistakenly confirmed a payroll and need to make amendments.

Step 1: Click the revert button at the bottom left, and it will revert the payroll to step 1 of the pay run.

Scenario 2:

The payroll approver has approved the pay run, and you realize that some items need amendments. The payroll is now at step 2 and approved.

Step 1: Click 'confirm payroll' to go to step 3

Step 2: Click revert payroll at the bottom left, and it will revert the payroll to step 1 of the pay run.

Scenario 3:

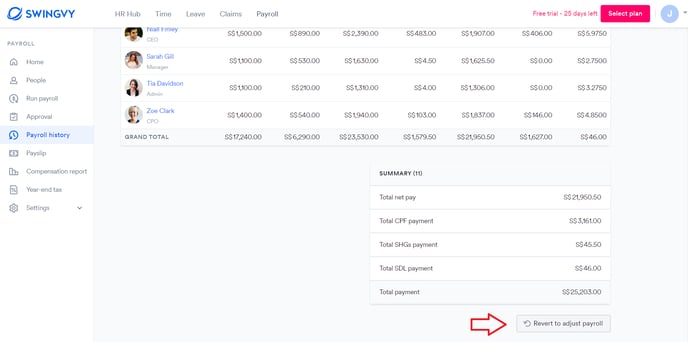

The payroll has been completed

Step 1 - Go to "Payroll history" > Click on the month payroll

Step 2 - Scroll to the bottom of the page and click on 'Revert to adjust payroll'

Note:

If the Monthly payroll is reverted in the completed stage, other Ad hoc/Mid-month payrolls are re-opened preserving the last payroll step.

Scenario 4:

You want to revert the previous month's payroll while the current month payroll is completed

Step 1: This can only be done from our side. To do so, you can contact support@swingvy.com.

Revert an Ad-hoc/Mid-month payroll

There may be a situation where you'd need to revert the Ad hoc/Mid-month payroll. To revert an Ad hoc/Mid-month payroll, the Monthly payroll needs to be in step 1.

Note:

Payslip will not be overridden when payroll is reverted. You need to send the payslip to all employees again after payroll completion because the previous link sent is not viewable anymore.