How to run Ad hoc payroll in Swingvy Payroll?

How to run an Ad hoc payroll?

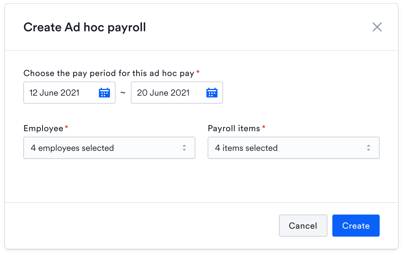

- Select the payroll period to follow by the Ad hoc payroll type

- The list is empty at first, select the employee to process in the Ad hoc payroll

- Select the Ad hoc payroll item to process. Example: Gross bonus

- Click on create Ad hoc pay button to generate the list, the selected employee will be generated with the desired Ad hoc field

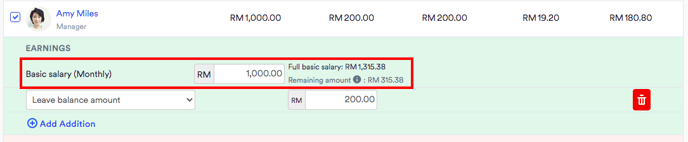

- Enter the Ad hoc amount

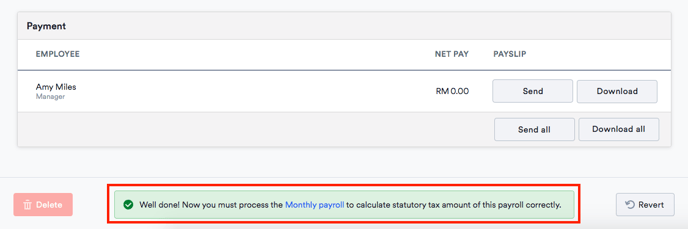

- Proceed the Ad hoc payroll to Step 3, Payment and Submission, for reports, bank payment and payslip

Now, Ad hoc payroll is able to be run multiple times in a month. You can separate the Ad hoc pay based on the department or employment status. However, if an employee has been added to an Ad hoc payroll, their name is unable to be added to a new Ad hoc.

On the other hand, for any Ad hoc that is incomplete, the admin can delete the record. Please ensure it is at step 1 or step 2 of the Ad hoc payroll for deletion.

Tip:

To delete the Ad hoc payroll, The monthly payroll cycle needs to be in Step 1, Adjust payroll as well. If the Monthly payroll is at step 2 or 3, the Ad hoc is unable to be deleted

On the other hand, you can also include a basic salary during Ad hoc payroll. You can edit the amount of basic salary accordingly and it will cap the amount of the total basic salary. The balance of the basic salary will be deducted and accumulated on the Monthly payroll.

Then, after the Ad hoc payroll is completed, you can straight away create a Monthly payroll by clicking on the box as image below. You can always log out and come back later for the Monthly payroll, this is one of the shortcuts you can use to start the Monthly payroll

Process the Monthly payroll with Net pay of Mid-month/Ad hoc payroll

- Once the Ad hoc payroll has been completed, it will be consolidated into the Monthly payroll automatically.

- Net pay of Ad hoc/Mid-month payroll will be deducted from the Monthly payroll.

- The final amount of statutory will be computed in the Monthly payroll, based on the final income given to the employee during the Monthly payroll

For your better understanding, here is one example scenario.

- (A): The number of statutory contributions and CPF payments will be automatically calculated in each Ad hoc payroll, based on the amount being paid out.

👇 How this Ad hoc payroll is consolidated with the Monthly payroll

- (C): All paid contributions from Ad hoc pay runs will be combined and consolidated into Monthly payroll as in the above example. The full monthly contributions are recalculated and adjusted based on total pay.

- (D): Net pay of Ad hoc payroll will be deducted from the Monthly payroll.

What if employees are paid in the Ad hoc payroll but not included in the Monthly payroll?

Employees paid in other Ad hoc payrolls instead of the Monthly payroll will be automatically included in the Monthly payroll in step 2 (Review & Confirm). This is to show the total of the employer's statutory amount for the month. The payment to the statutory body will be made once a month, thus, all statutory amounts will be accumulated on the Monthly payroll. Only the statutory-related items of these employees will be included in the payment summary calculations.