How to submit employment income records to IRAS electronically

Important notice:

-

Swingvy doesn’t support the Appendix 8A, and Appendix 8B.

- IR8S is not required anymore from YA2026. Any refund claim amount must be submitted under the item ‘Allowances’ in the IR8A form.

- Please exclude those employees that have Benefits-in-Kind or Employee Stock Option from Swingvy's AIS submission and do a manual submission to IRAS via myTax Portal for both IR8A & Appendix 8A for them instead.

- Learn more here

It is compulsory for companies with 5 and above employees to apply for Auto Inclusion Scheme (AIS) under IRAS. For a company that has less than 4 employees, it is also encouraged to join AIS too for easier tax processing.

Note:

-

You do not need to import your past payroll data for IR8A.

-

When the form is generated, editing is possible.

-

Forms are generated once during submission.

- If any updates are made to the payroll or the payroll history bulk upload file after the form is generated, please delete the existing file and generate a new one to reflect the updated information.

Step 1 - Create tax filling by selecting the employee

To begin, select the employee who are eligible for IR8A submission.

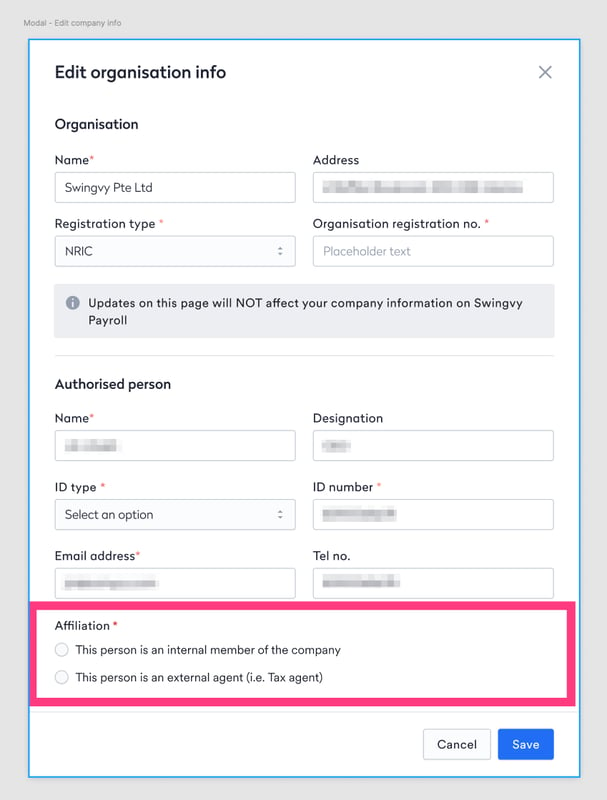

Step 2 - Update your organisation info

In this section, 3 columns are needed:

- Determine your IRAS registration types

- Determine your organisation registration number

If you are unsure about your organisation registration number, here is how you can get yours:

- Your GST Registration Number

This is the number you have to print on your invoices, credit notes and receipts. - Your Effective Date of GST Registration

This is the date when you have to start charging and collecting GST on your taxable supplies. You must not charge or collect GST before the effective date of your GST registration.

You may also retrieve a copy of the notification letter by logging in to myTax Portal (select “Notices/Letters”)

- Update PIC information

You also need to enter the affiliation of the PIC to the company. The selection of affiliation is either the PIC is:

- An internal member of the company (Company's staffs)

- An external member (Tax agent)

Step 3 - Update your employees’ IR8A

At this step, you have the option to edit the IR8A form, send the IR8A form to employees, and download the IR8A form.

Step 4 - Validate your IRAS

Note:

Kindly make sure that your company is registered for submission via (Auto-Inclusion Scheme) AIS before proceeding with the submission in Swingvy. Registration can be done before 31st December every year for the following year's submission. Learn more about the registration here.

Note:

-

The submission button is only available when the validation is error-free.

-

The error message is validated by the IRAS website. Please check the error message and update it accordingly.

- Validation may fail if your CorpPass account does not have approver access. Please follow the guidelines here to ensure you have the correct access to proceed with the validation and submission.

Example:

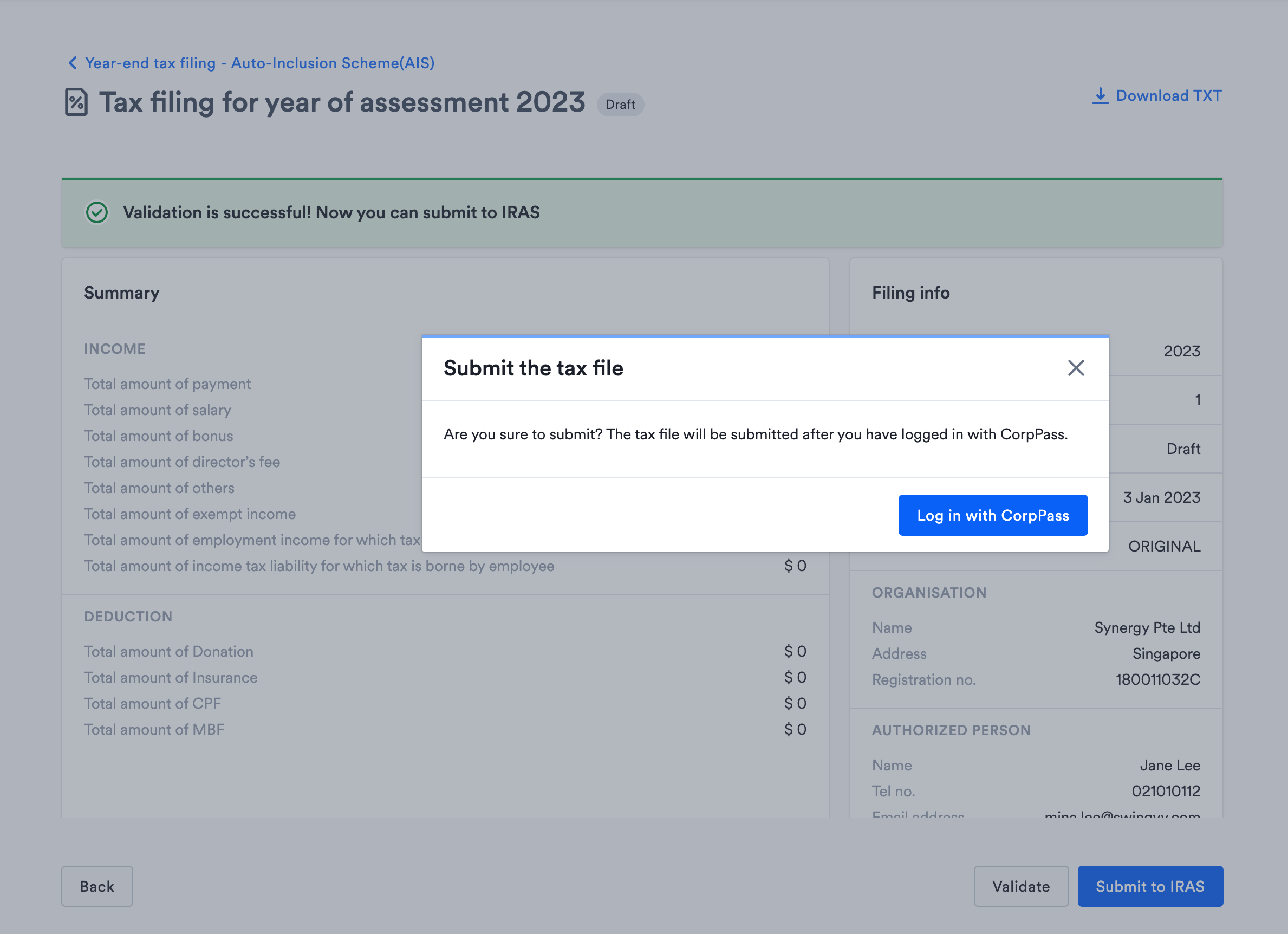

Step 5 - Submit to IRAS

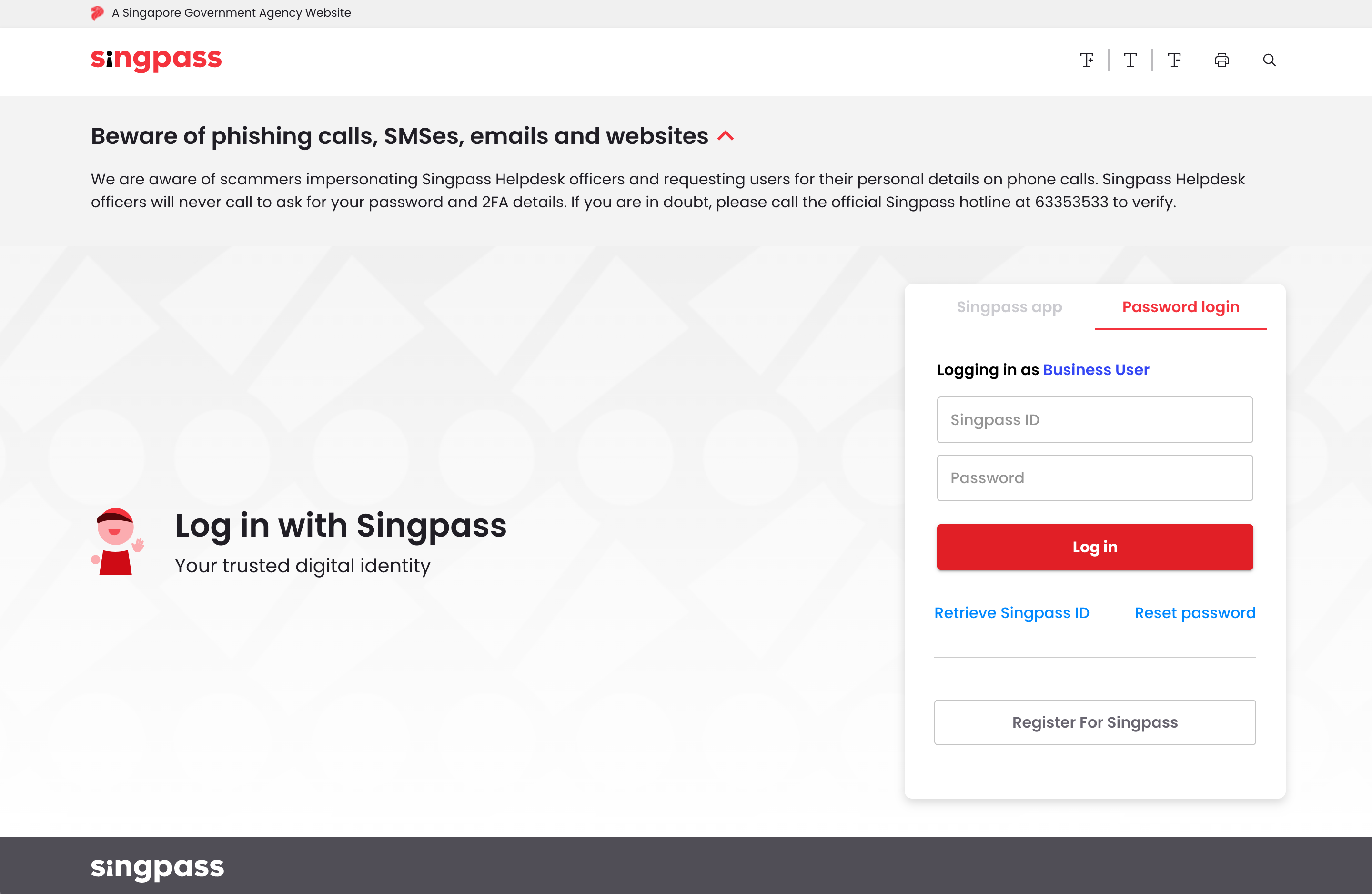

Currently, there is a security authentication before submitting to IRAS.

Step i - After clicking the submit button, there will be a message box to login with CorpPass

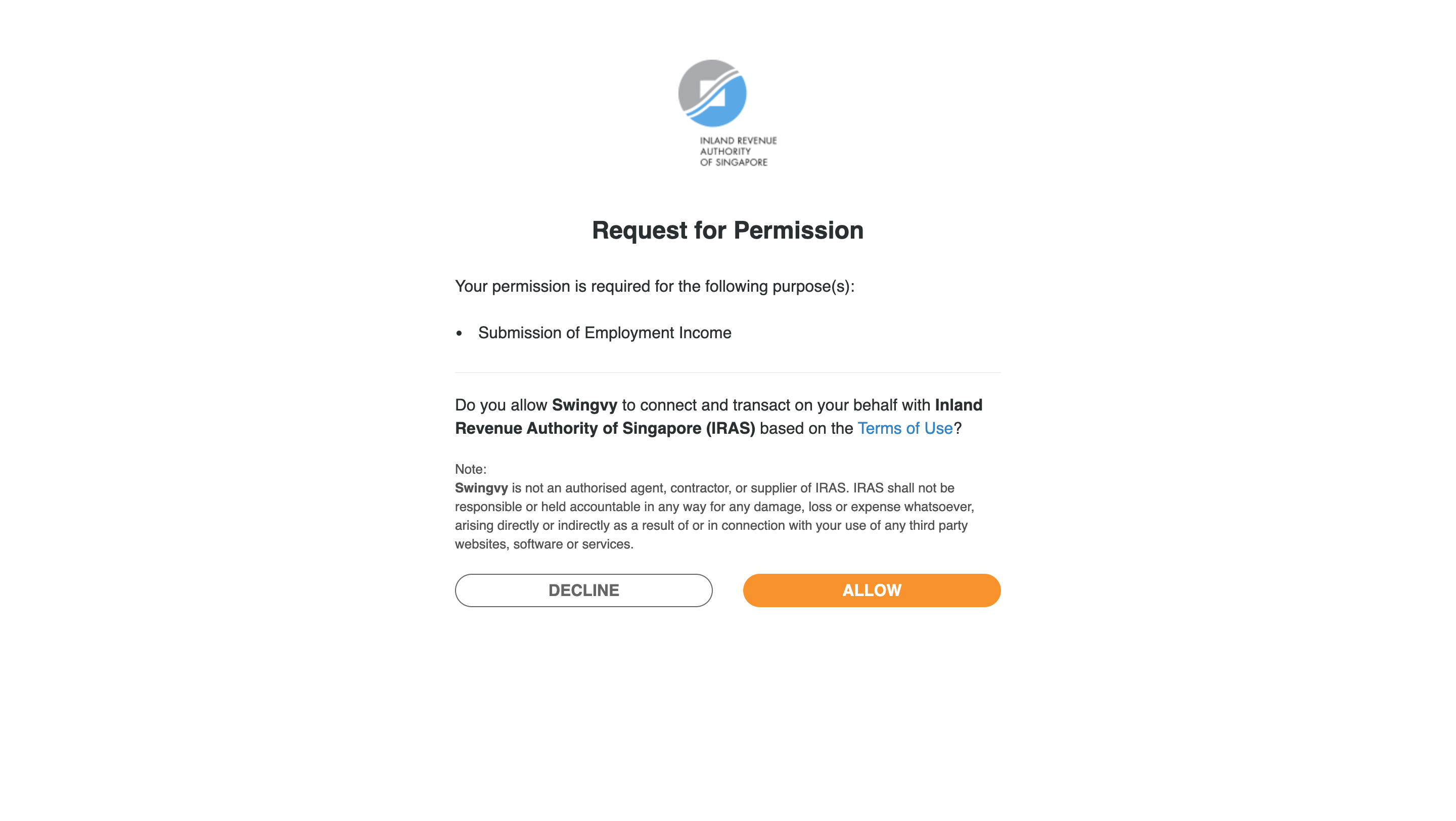

Step ii: Once you log in to CorpPass, you need to provide permission. Only after the permission is granted Swingvy is able to submit the tax filings.

Note:

-

Validation and submission may be unsuccessful due to a token expiration from the Corppass login page. The session typically expires after 30 minutes, and you’ll need to refresh the page and repeat the process.

- Validation may fail if the telephone number under the authorised person contains spaces. Please ensure the number is entered in the correct format as registered, for example: +6512345678 or 6512345678.

-

Once the submission is completed, it will be marked as “Submission successful” in the Swingvy portal.

-

Please ensure that you have received the confirmation email from IRAS.

Reference link: