HRD Corp/HRDF

What is HRD Corp (formerly known as HRDF)?

Human Resources Development Fund (HRD Corp) is a government agency under the Ministry of Human Resources which is currently known as Pembangunan Sumber Manusia Berhad Act 2001 (PSMB).

The PSMB Act 2001 aims to provide for the imposition and collection of a human resources development levy for the purpose of promoting the training and development of employees, apprentices and trainees, the establishment and the administration of the Fund by the Corporation and for matters connected therewith.

In line with their vision, HRD Corp provides training and up-skilling interventions to key industries in Malaysia to keep up with the fast-evolving business landscape and their individual company aspirations.

What is HRD levy?

If your company falls under the act are obligated to register with HRD Corp and requires to contribute HRD levy every month. The objective is to facilitate employee training and skills upgrading in the Malaysian workforce.

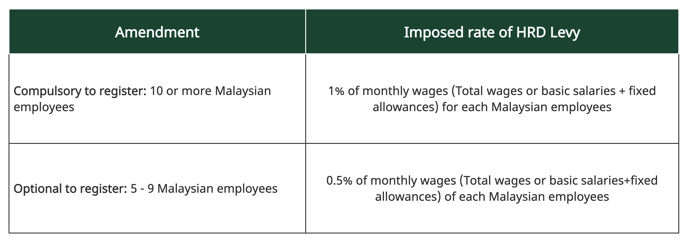

The levy fee for registered employers is 1% of the monthly salary of each employee. In comparison, employers under the optional category who choose to register will be 0.5% of each employee's monthly salary.

Who is eligible to register with HRDF?

Companies with 10 or more Malaysian employees are mandatory to register, while a company with 5 to 9 Malaysian employees are optional. According to the First Schedule of PSMB Act, 2001, definitions of industries covered are as follows:

How do you define which employee is eligible to contribute to HRDF?

This includes all employees who are under a 'Contract of Service' with the company. You can see the below examples.

Note:

1. Employers under the newly-included industries were originally given an exemption from HRDF levy for 3 months from 1 March to 31 May 2021. The exemption has then been extended until Jan 2022 (no levy due for June to Dec 2021 payrolls).

2. As per HRDF regulations, once you reach 10 Malaysian employees you must continue contributing at 1% for the whole calendar year even if your headcount falls below 10 employees during the calendar year.

3. Payment is due no later than the 15th of the following month.

How is the HRDF levy calculated?

HRDF levy for each Malaysian employee = HRDF Levy% x (Basic Salary - Unpaid leave + Fixed Allowances)

Example of HRDF levy calculation:

If you are contributing 1% and your employee earns RM3,500 with a fixed allowance of RM250, then the calculation for the HRDF levy will be as follows:

(RM3,500 + RM250) * 1% = RM37.50

How can I add the HRDF levy in Swingvy Payroll Software?

Swingvy payroll software is approved by LHDN / IRB and will calculate your HRD contribution automatically - you will need to check off the box for "contribute to HRDF".

Do take note that while Swingvy automatically calculates the HRDF amount, payment will have to be made separately and is not integrated with Swingvy.

Note:

- In Swingvy, HRD contributions are rounded to two decimal places at the employee level, then summed up to get the final total contribution (in line with HRD guidelines here).

- The total HRD contribution can’t be calculated based solely on the total salary of Malaysian employees. Instead, it must be calculated individually for each employee and then added together.

Example:

(Employee A basic salary × 1%) + (Employee B basic salary × 1%) + … - If employers make payment directly on HRD website, it would be based on the Total wages keyed into the system*percentage; However, employers can fill in the HRD contribution amount manually to overwrite the HRD website amount (input based on the payroll system amount).

- You can refer here for more FAQ on HRDF.