MyTax Portal: Apply for Employer/Employer Representative role for E form submission

To access e-PCB Plus or submit E forms, it is necessary to hold an Employer or Employer Representative role. Below is a comprehensive step-by-step guide to assist you in applying for an employer role and appointing an employer representative in MyTax.

Applying for the Employer role

For Private Companies

A company director must initiate the application for the role of Director in their MyTax account. The approval process typically takes up to 5 working days, and upon successful completion, the director will be automatically assigned the Employer role.

Below is a detailed guide on how to proceed with this application:

- Navigate to https://mytax.hasil.gov.my/ and log in to your account

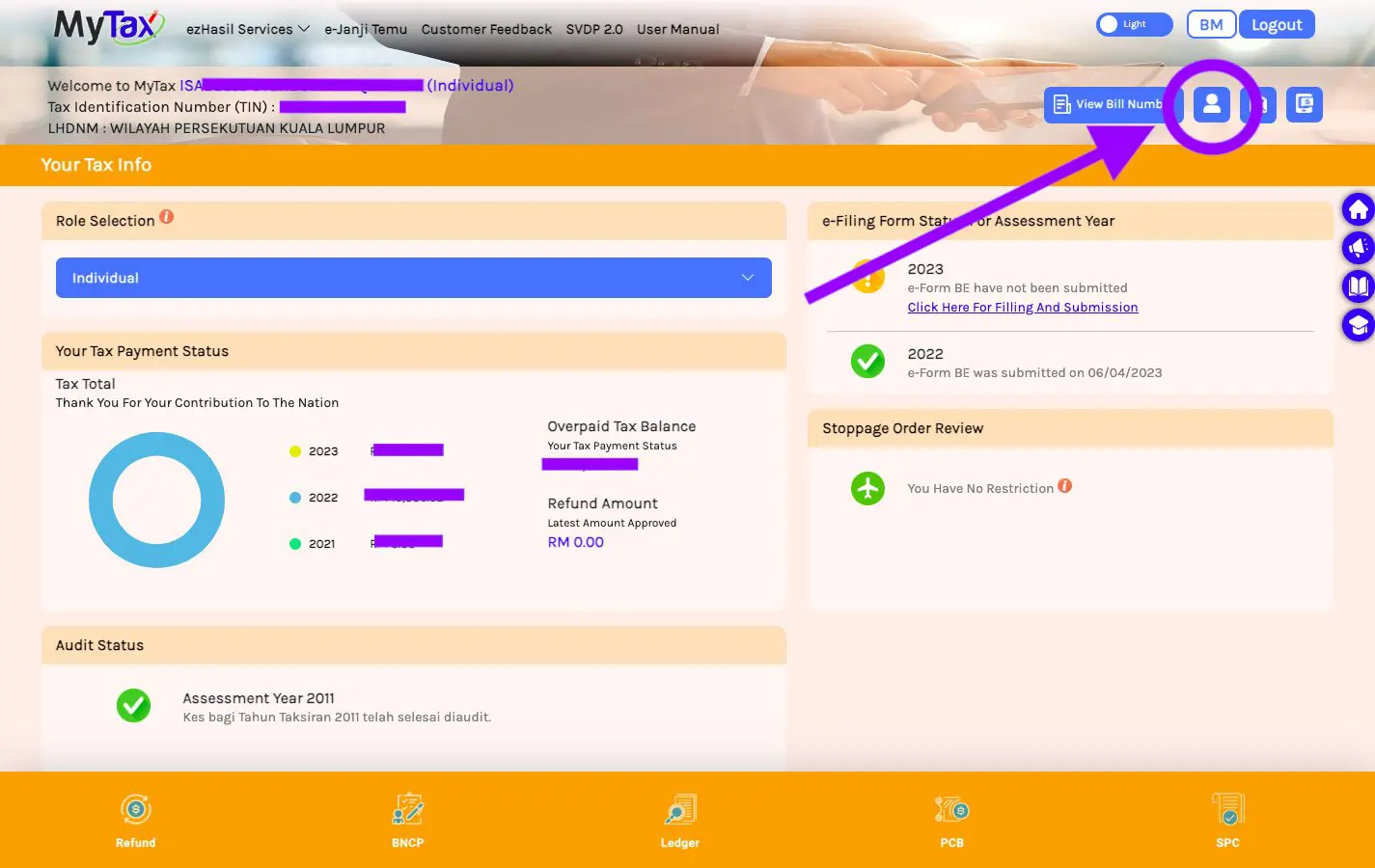

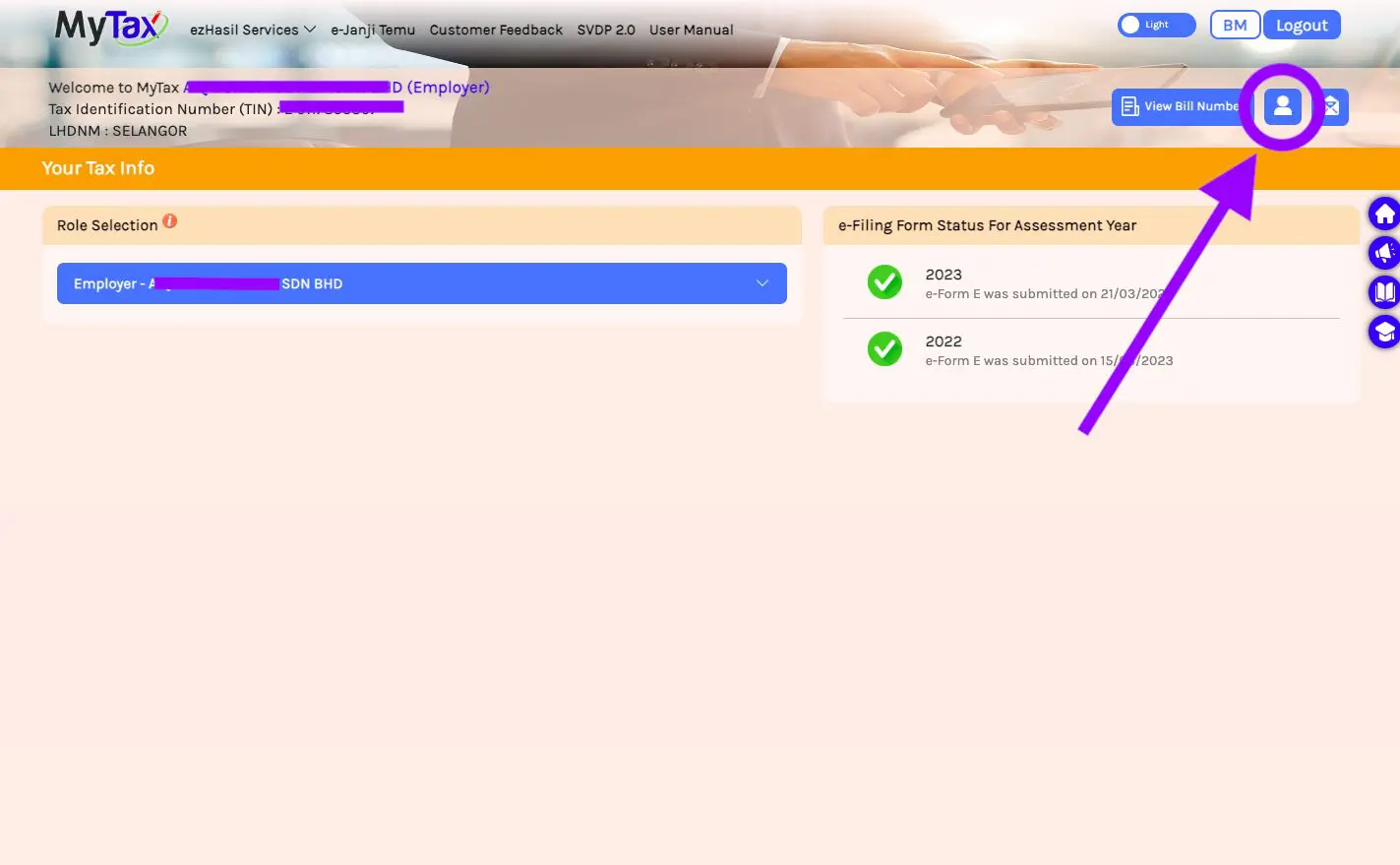

- Once logged in, locate the profile icon situated in the top right corner of the page

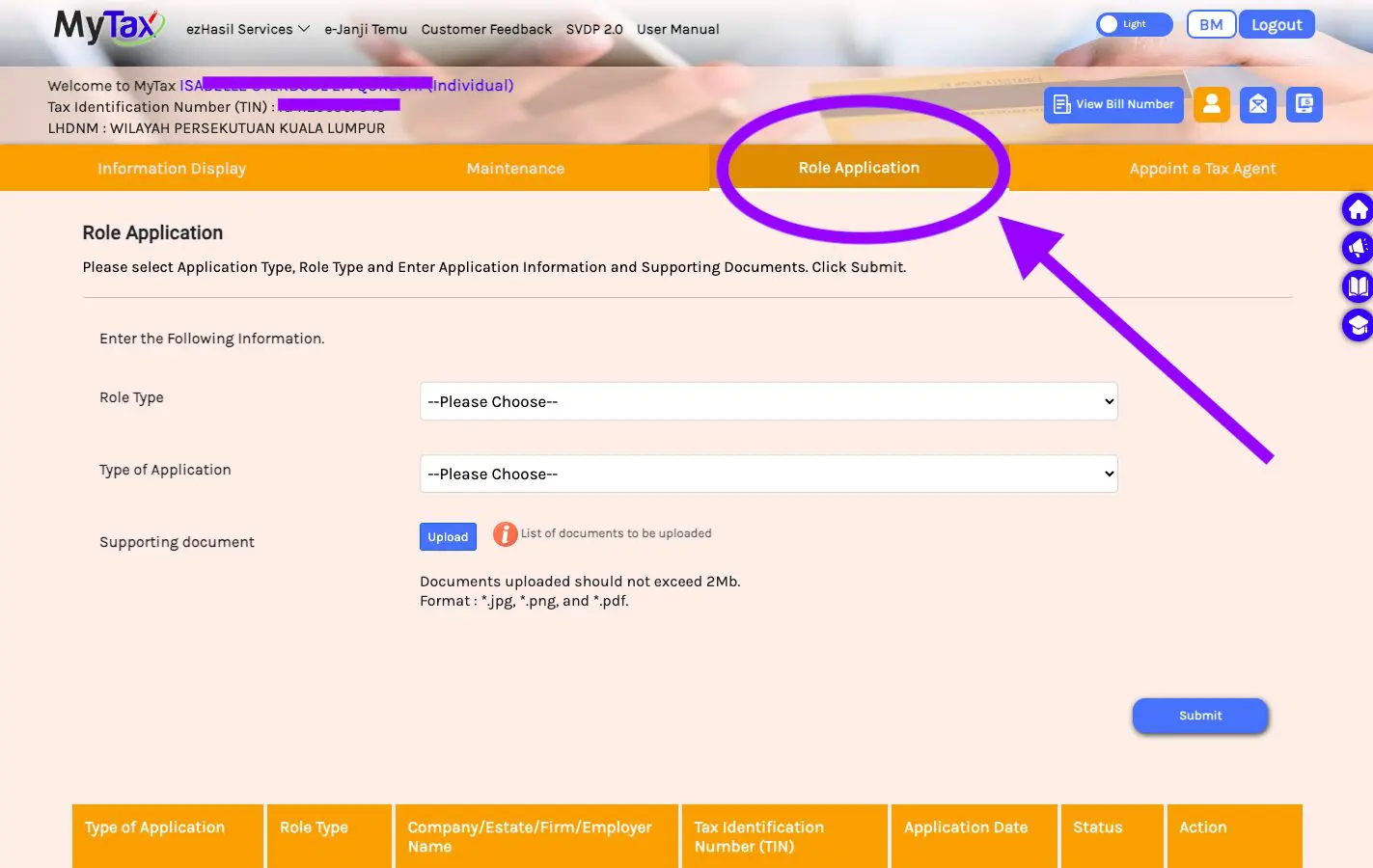

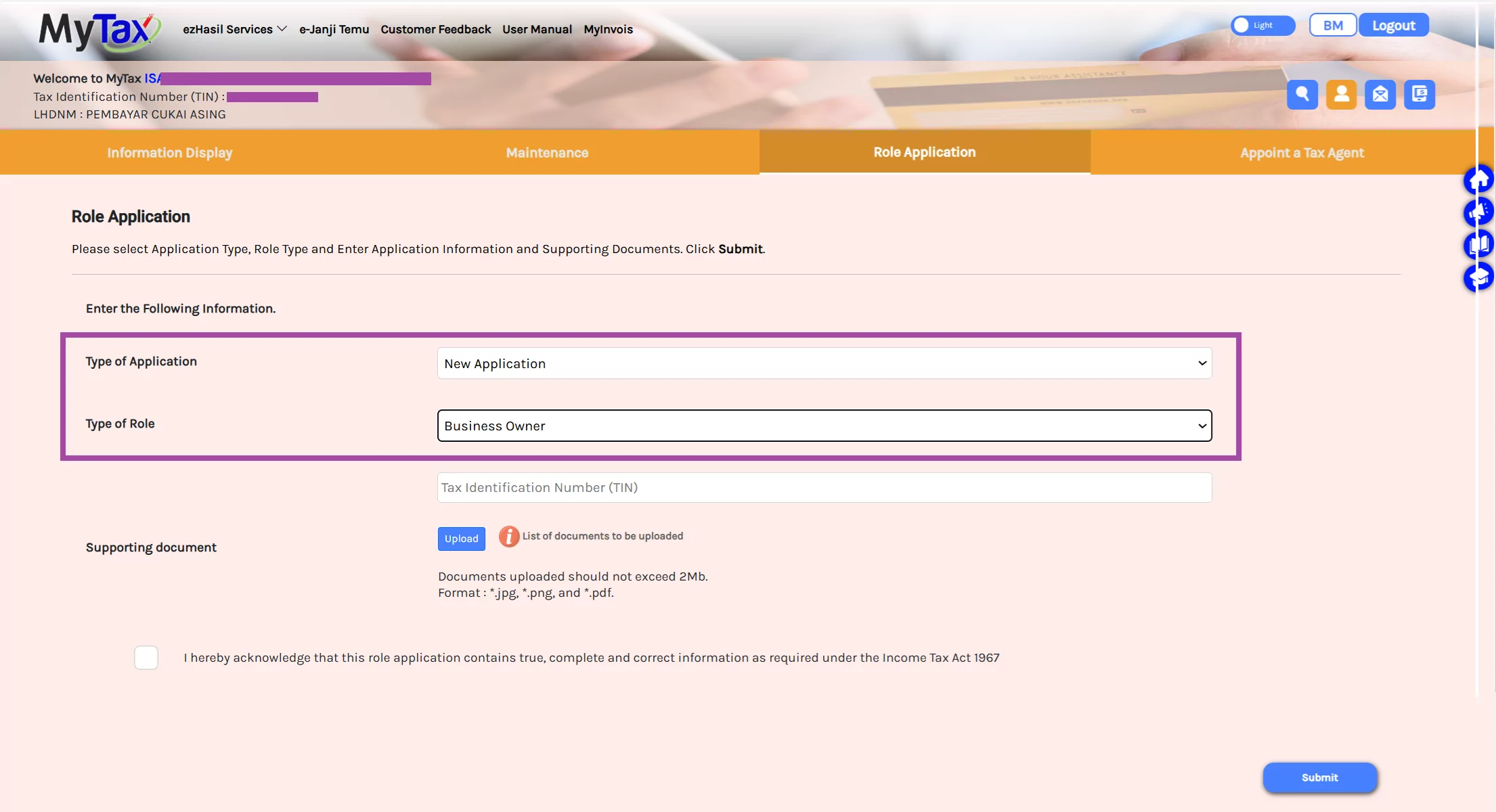

- Navigate to the third tab named Role Application

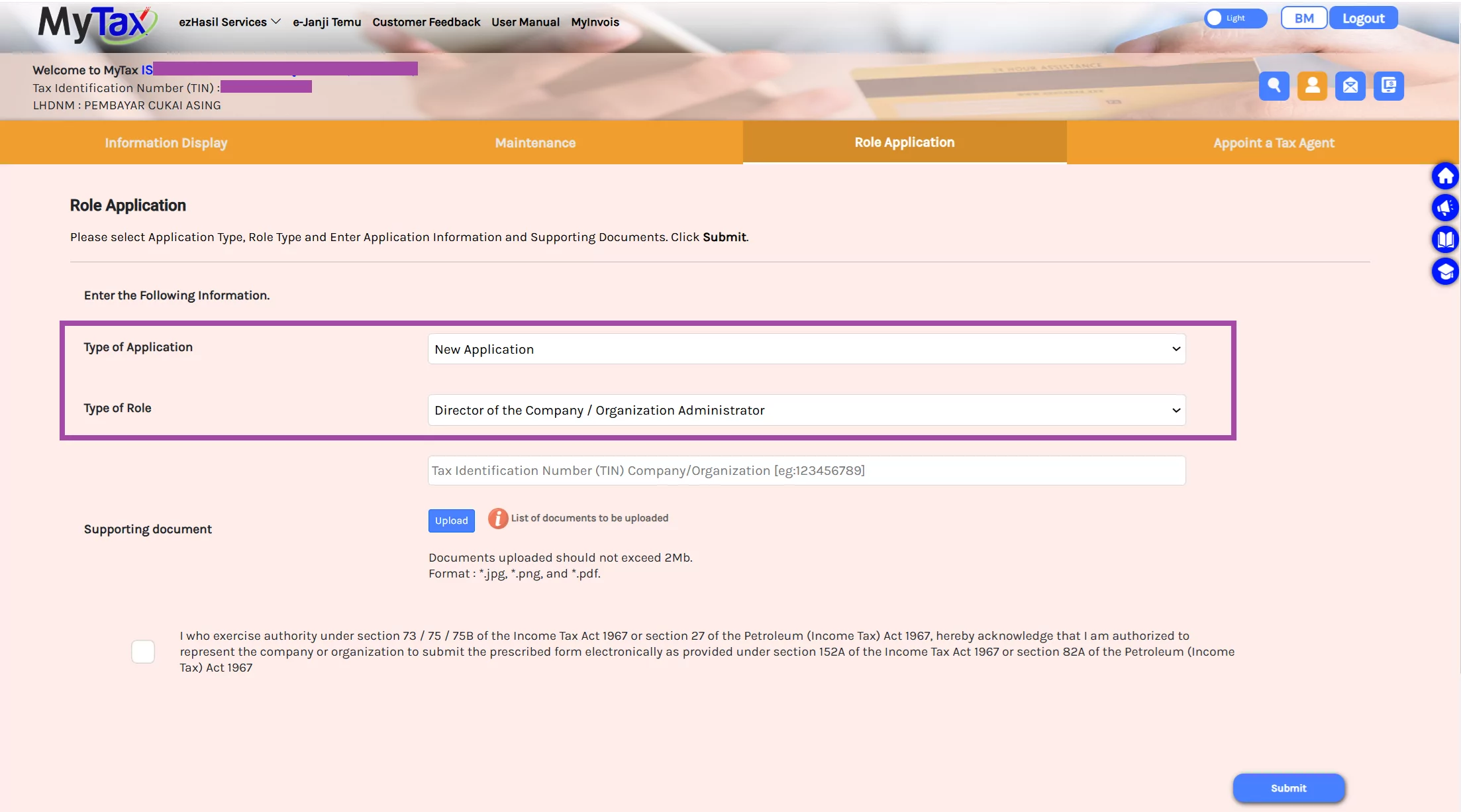

- Select Type of Application as New Application

- Select the Type of Role as Director of the Company / Organization Administrator

- Enter your organisation’s TIN (Tax Identification Number)

- Upload the following documents as supporting documents:

- (i) Certificate of Registration (Form 9/Form Section 17) and

- (ii) List of directors (Form 49/Form Section 14)

- Click on the checkbox and press Submit

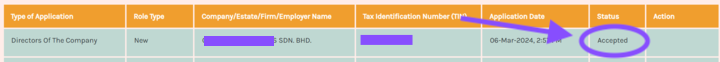

- Once you have submitted your application, please allow up to 5 working days for processing. You will receive a status update indicating that your application has changed from New to Accepted upon approval.

For Sole Proprietors and Partners

For sole proprietors and partners, the application process mirrors that of company directors, with the key distinction being the selection of the role type as Business Owner. Upon successful application, these individuals will automatically receive the Employer role. It is important to upload the appropriate documentation, which includes a copy of the business registration certificate. If a sole proprietor does not possess a business registration certificate, a copy of their identity card (IC) should be submitted instead.

Appointing an Employer Representative

If you hold the Employer role, you have the opportunity to appoint an Employer Representative in MyTax. This representative will assist you in submitting employer forms through their MyTax account.

The following steps outline the process for making this appointment:

- Before you begin, it is important to recognise that holding the Employer role is a prerequisite for appointing an Employer Representative. If you have not yet applied for the Employer role, please refer to the previous section for a detailed step-by-step guide on how to do so.

- Please navigate to https://mytax.hasil.gov.my/ and log in to your account

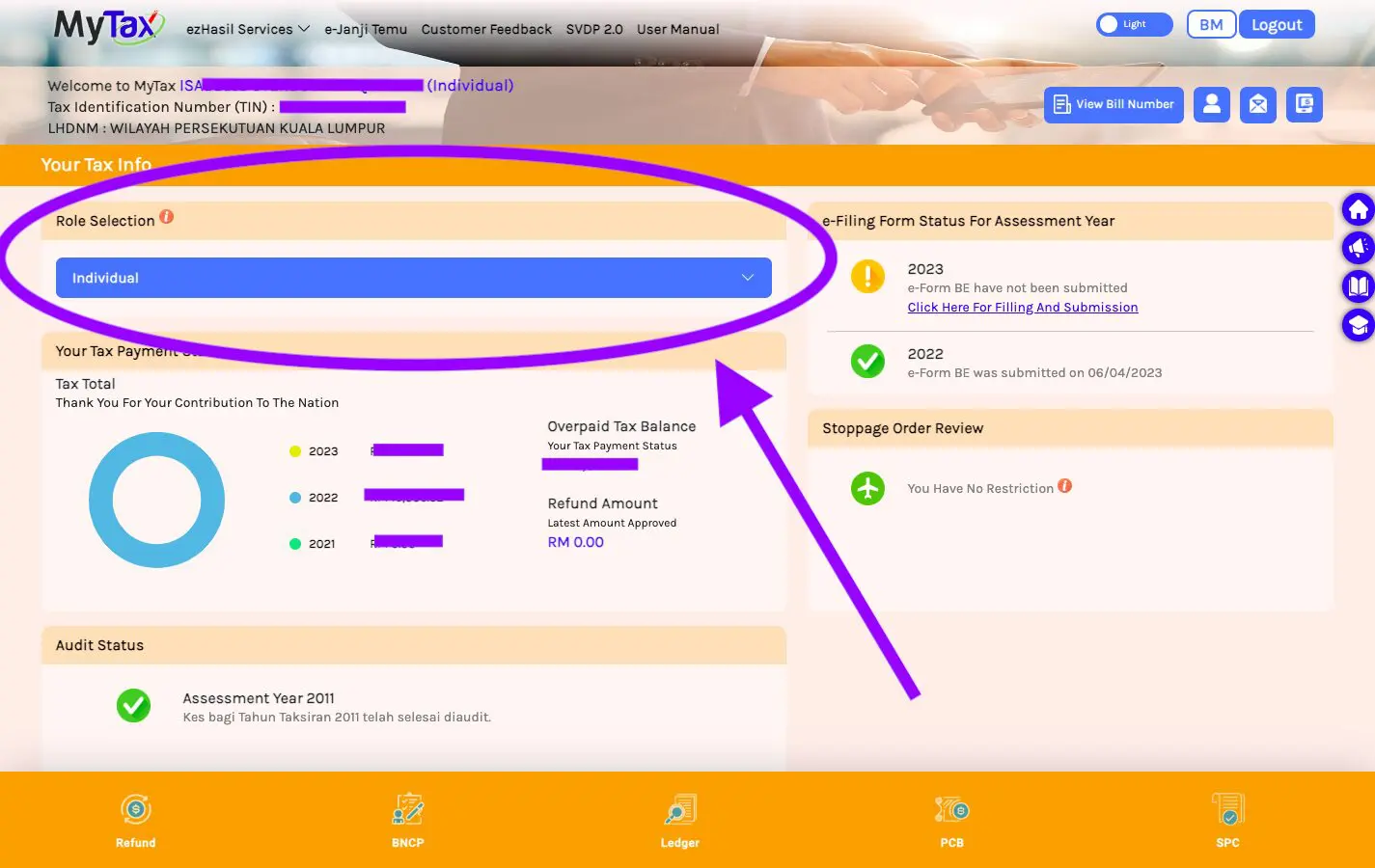

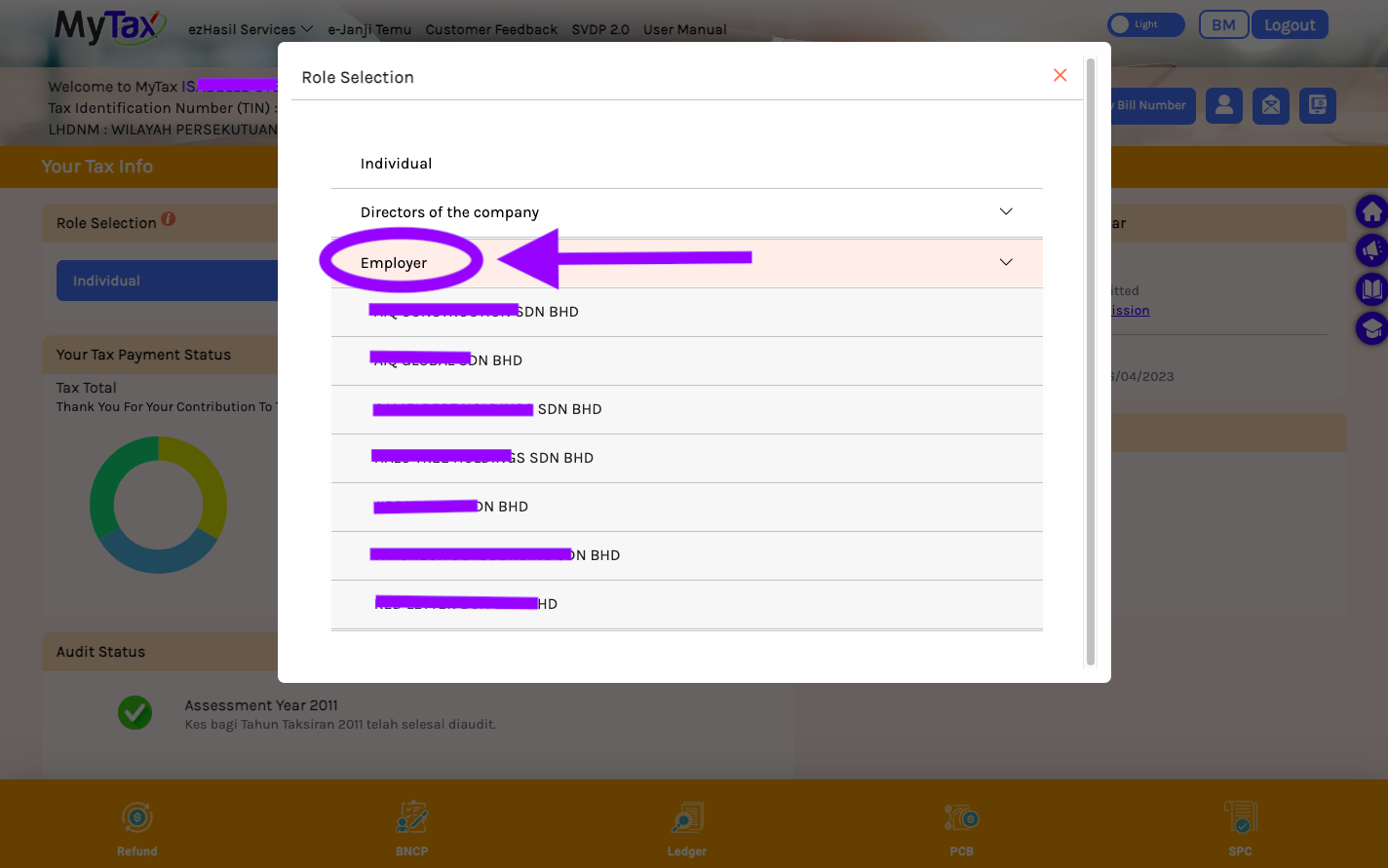

- Once logged in, locate the Role Selection section and click on the blue tab

- Select the Employer option and specify the entity for which you wish to designate an employer representative

- Click on the profile icon

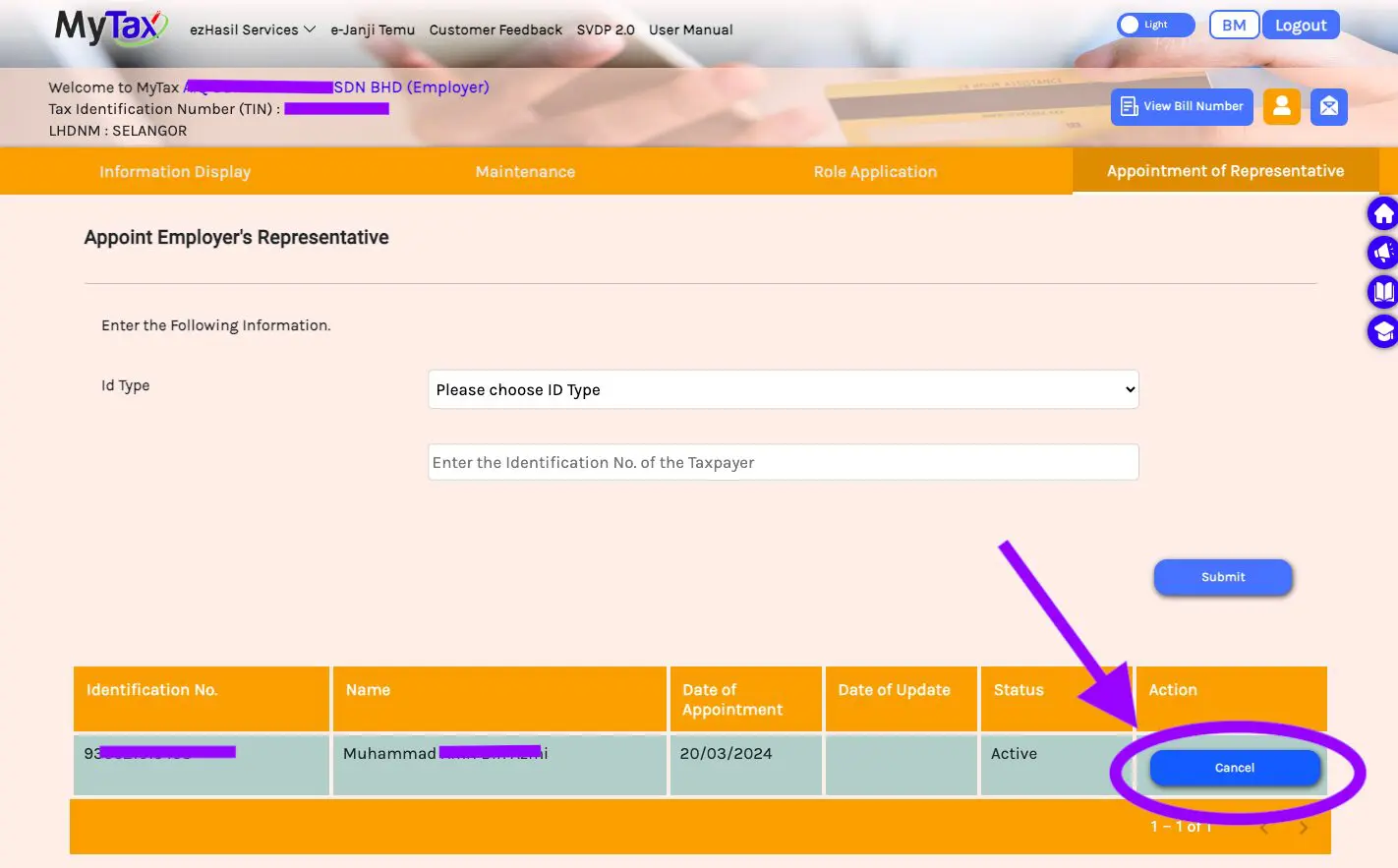

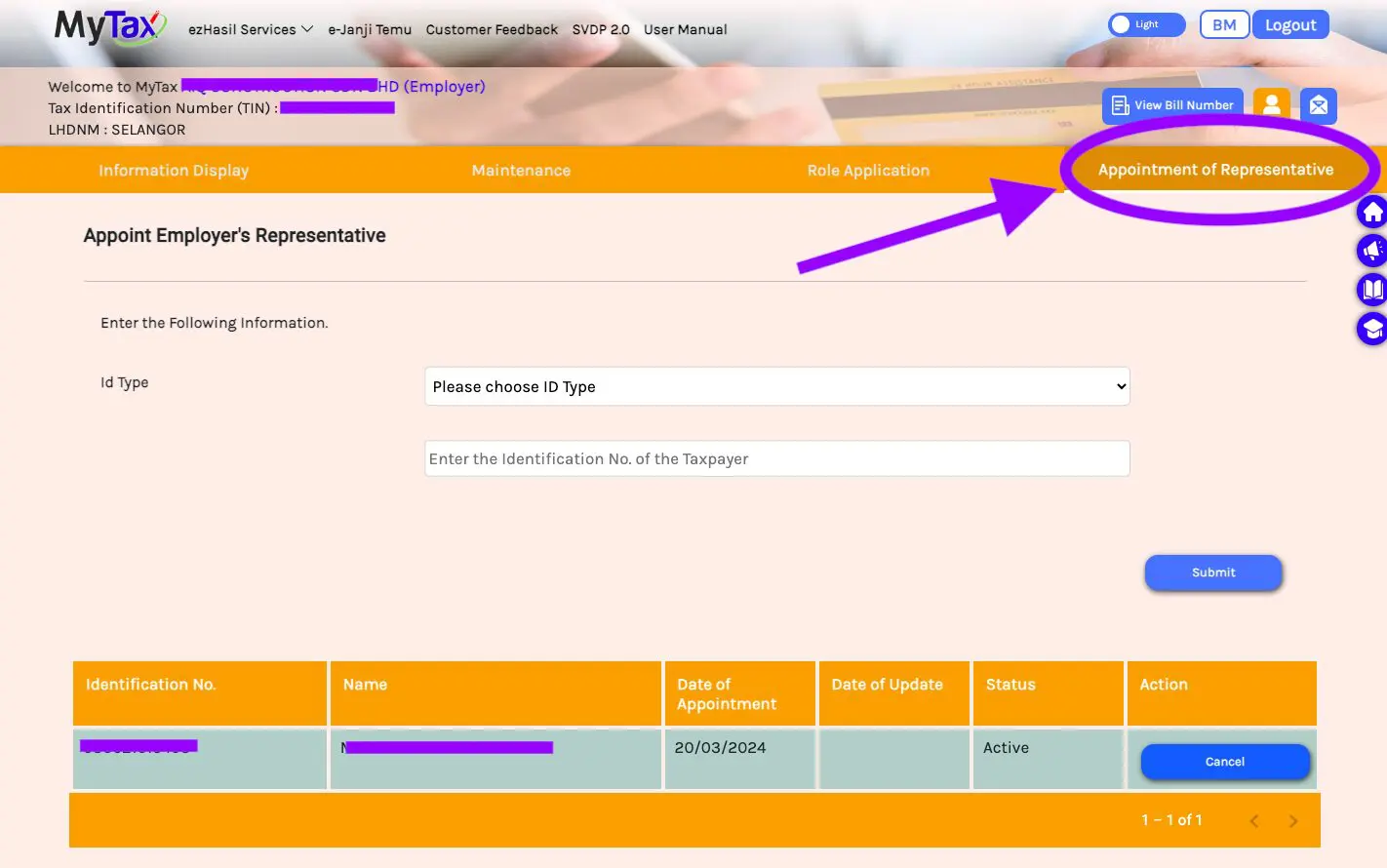

- Go to the fourth tab named Appointment of Representative

- Choose the type of ID and insert the ID number of the person you want to appoint as an employer representative

- Click Submit

- Your appointment is now complete!

The appointed representative will be listed in a table at the bottom of the page. If you wish to revoke their status as a representative, simply click the Cancel button to proceed.