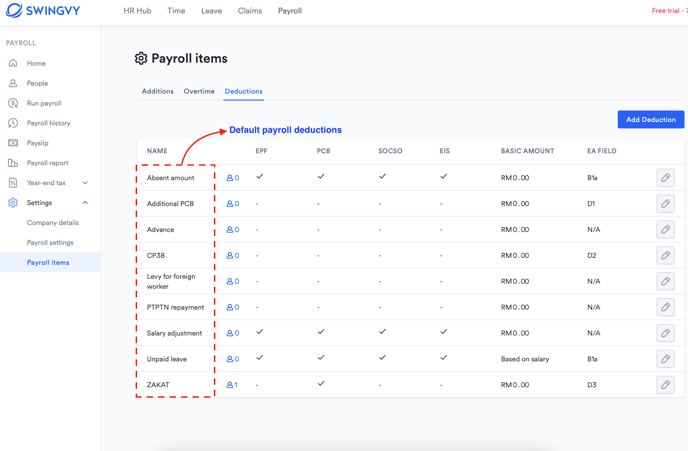

Payroll items - Deductions

Payroll Deduction is anything that is taken from an employee's pay, whether it be pre or post-tax, other than payroll taxes themselves.

We provide two options for creating the list of your payroll items - Deductions:

We provide two options for creating the list of your payroll items - Deductions:

1. Most common Deduction items (default)

Swingvy added the most common (frequently used) Deduction payroll items for you.

This standard Deduction item is created by default and you are not allowed to edit the below category:

This standard Deduction item is created by default and you are not allowed to edit the below category:- Name: A unique name for the deduction payroll item

- Category: Click on the drop-down list for the below selection

- Allowance (normal monthly tax computation will be applied)

- Remuneration (bonus tax computation will be applied)

- Statutory: Statutory attribution

- EA form field: EA form output column

Create your own customized deduction items if necessary. To make further changes to a payroll item, scroll down to No 2 - Customised Deduction items to learn how.

However, these default Deduction items can be edited in the:

-

Updating the unit amount of Deduction items

-

Select employees for monthly recurrence

2. Customised Deduction items

Select this option if you need to set up your customised Deduction items:

a) Enter the new Deduction name

b) If the Deduction is unit base, select the checkbox and enter the per-unit amount

c) Select the statutory which will be subjected to this Deduction

b) If the Deduction is unit base, select the checkbox and enter the per-unit amount

c) Select the statutory which will be subjected to this Deduction

Learn more about Deductions items:

- Name: Enter a unique name for the new payroll item

- Calculate by unit – When you run payroll, you can calculate the amount by entering the ‘No. of unit’. (Formula: ‘Unit amount’ x 'No. of unit')

- Statutory: Tick on the statutory attribute for this new item

- EA form field: Select the EA form output column from the selection list

- Select employee(s) for monthly recurrence - Apply to all or selected employees