Skills Development Levy (SDL)

In Swingvy, we auto-calculate the SDL amount for you in the Month-end payroll.

What is Skills Development Levy (SDL) for?

The SDL collected are channeled to the Skills Development Fund (SDF), and is used to finance workforce upgrading programs and to provide training grants to employers when they send their employees for training under the National Continuing Education Training system.

The SDL and SDF are managed by the SkillsFuture Singapore Agency (SSG).

CPF Board collects SDL on behalf of the SkillsFuture Singapore Agency (SSG)*.

In addition to the CPF contribution and Foreign Worker Levy, Skills Development Levy (SDL) is another mandatory levy that employers have to pay for all employees working in Singapore, including:

- employees employed on a permanent, part-time, casual, and temporary basis

- foreign employees on work permits and employment pass holders

The SDL for foreign employees should be added to the Foreign Worker Levy and is payable to the Ministry of Manpower.

*If you'd like to know more about which categories of employees are exempted from SDL, please refer to the Frequently Asked Questions (FAQs) on Skills Development Levy at SkillsFuture Singapore Agency (SSG) website.

What is SDL contribution rate and how is it calculated?

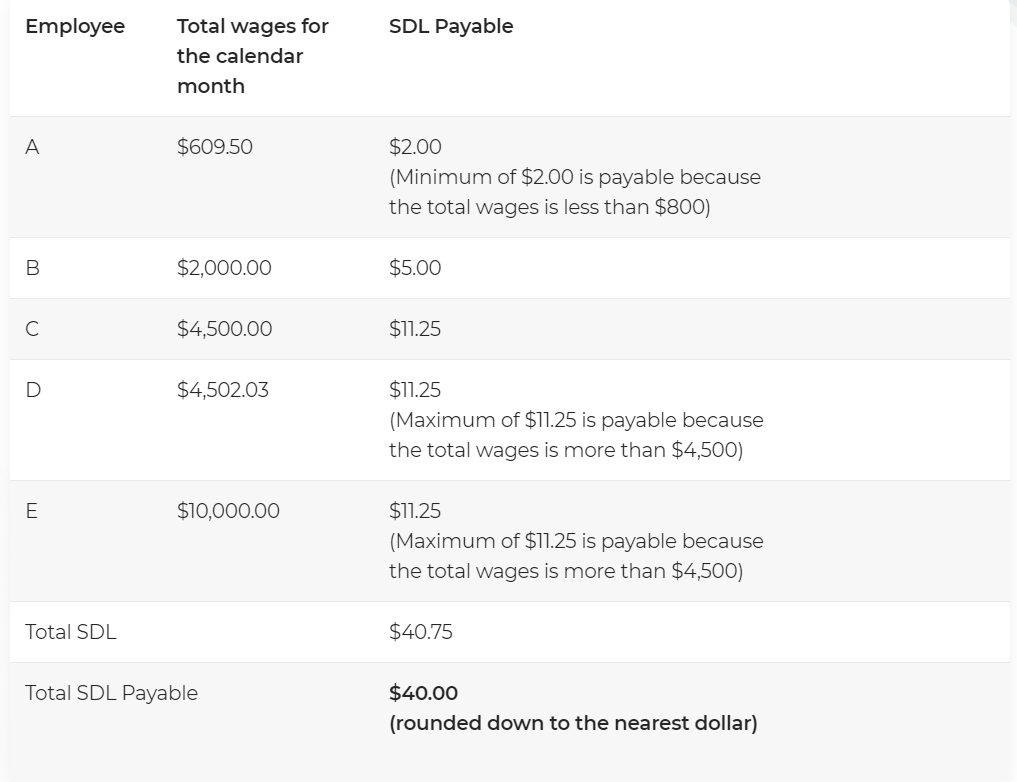

Under the SDL Act, employers are required to contribute SDL for all employees* up to the first $4,500 of each employee's total monthly wages at a levy rate of 0.25% or a minimum of $2 (for total wages of $800 or less), whichever is higher.

* Employees include full-time, casual, part-time, temporary, and foreign employees rendering services wholly or partly in Singapore.

The total monthly wages include any salary, commission, bonus, leave pay, overtime pay, allowance, and other payments in cash.

After computing the SDL for each employee, you need to add up the total amount of SDL payable and round down to the nearest dollar. Here’s an example of an SDL computation:

Note:

1. The SDL must be paid within the 14th day of a month for the previous month. For example: If you want to pay the SDL for June, then you have to pay it by July 14.

2. You will be penalized with an extra of 10% per annum on the total outstanding amount of SDL for late payment.

In Swingvy, you might find some discrepancies if the payroll report is compared to the CPF file (on the CPF website). The difference is caused by The Skill Development Levy (SDL). It is part of the SDL file format that requires the final amount of SDL will be rounded down to zero at the organization level in the report. Hence, you shouldn't worry about this and you can proceed with your submission accordingly.

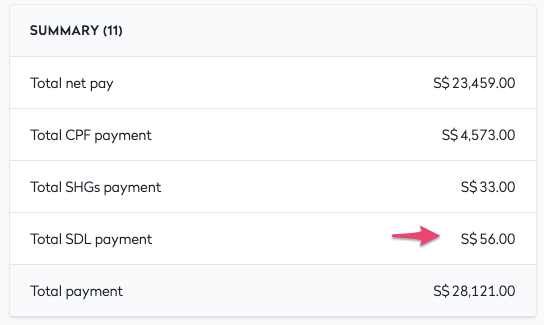

You can check/view the final SDL contribution amount in Swingvy at:

1. The Payrun process, Step 2

2. The month-end report (PDF) Summary

-png.png)

Useful links: