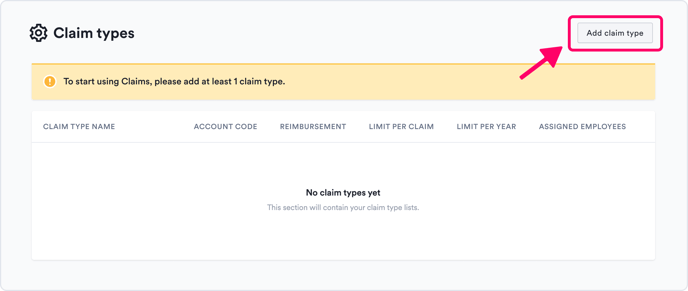

Step 2 - Add and set up a claim type

Claims > Settings > Claims Type

At least one claim type should be added to your account so that users can start utilising to Swingvy Claims. There is no default claim type in this setting as we understand that every company has their own claim policies.

How do I begin creating a claim type?

Click on "Add claim type". Follow these guidelines:

Learn more about claims types:

Claim type

The title is the name of your claims. These are three types of reimbursements that are common in most organisations:- Business Expense Reimbursement

- Auto Mileage and Travel Reimbursement

- Medical Expense Reimbursement

Examples:

1) Business expense reimbursement

The main type of claim is business expense reimbursement. These are typically expenses incurred by an employee for business purposes.

- Business travel

- Education or training

- Business supplies

- Business tools

- Miscellaneous business-related expenses

2) Auto Mileage and Travel Reimbursement

The second main type of employee reimbursement is for auto mileage and travel expenses. Technically, this is a type of business expense reimbursement. However, there are some specifics to note on.

- Standard Mileage Rates. Most businesses use standard mileage rates when reimbursing employees for personal automobile travel.

- Per Diem Travel. If employees are travelling away on business, the business can offer a fixed “Per Diem” allowance for lodging (excluding taxes), meals, and incidental travel expenses.

3) Medical Expense Reimbursement

The third main type is medical expense reimbursement. There are a few different types of medical expense reimbursement plans, and their usage (and tax benefits) vary.

Note:

Description for claim type is visible for admin reference only.

Claim limit

1. No limits

Uncapped claim amount

2. Per claim limits

The capped amount per claim item submitted

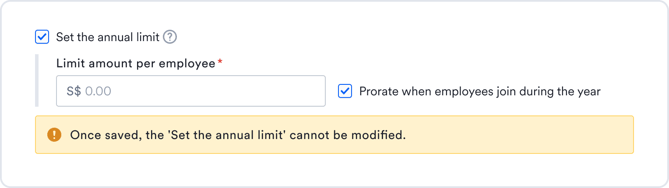

3. Set the annual limit

The capped amount for the calendar year

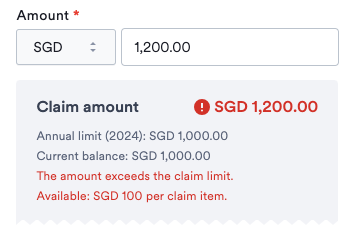

If you've set up annual claim limit, you can review the limit assigned to the employee, amount used and their balance via the page to set up these claim types

Note:

- If an annual limit has been set up, do note that the claim balance is calculated based on the date of transaction.

For example:- Annual claim limit per employee: $1,200

- Only 1 claim of $1000 was submitted on 5th January 2024

- Date of transaction for claim falls on 26th December 2023

- The deduction of $1000 will be applied to the employee's 2023 annual limit

- The employee will still be able to claim up to $1,200 in 2024

- Employees will not be able to submit the claim if the claim amount exceeds the employee's annual balance/limit

- Only pending and approved claims would be used to calculate user's claim balance

- It is not possible to edit the settings for annual limit once the claim type has been configured

- When you create a new claim type and enable “Set the annual limit”, it is not possible to disable it in future

- Vice versa - when you create a new claim type and disable the setting for “Set the annual limit”, it is not possible to enable it in future

- When you create a new claim type and enable “Set the annual limit”, it is not possible to disable it in future

- If the option for "prorate when employees join during the year" has been selected, do note that the proration is calculated based on the month of the user's join date only

- For example:

- The annual limit set is $ 12,000 and the new user's join date is 21st January -> the annual claim limit value is $12,000

- The annual limit set is $ 12,000 and the new user's join date is 1st of July -> the prorated amount will be $6,000

- The annual limit set is $ 12,000 and the new user's join date is 21st July -> the prorated amount will be $6,000

- For example:

Reimbursement method

Reimbursement is compensation paid by an organization for out-of-pocket expenses incurred or overpayment made by an employee, customer, or another party. Reimbursement of business expenses, insurance costs, and overpaid taxes are common examples.

1. Direct payment

Payment is excluded from payroll.

2. Payroll

Payment will be paid together when processing month-end payroll.

Note:

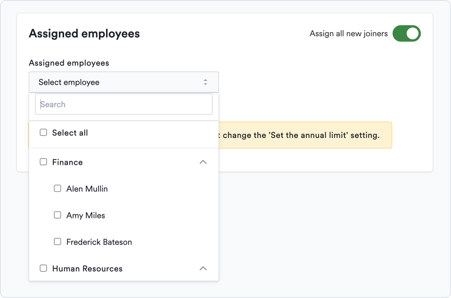

Assigned employees

Depending on your claim policy, you may allow all or only selected employees the option to submit the created claim type.

Note:

- Only employees assigned to the claim type can view and submit request

- With "Assign all new joiners" on, they're automatically assigned to this claim type.

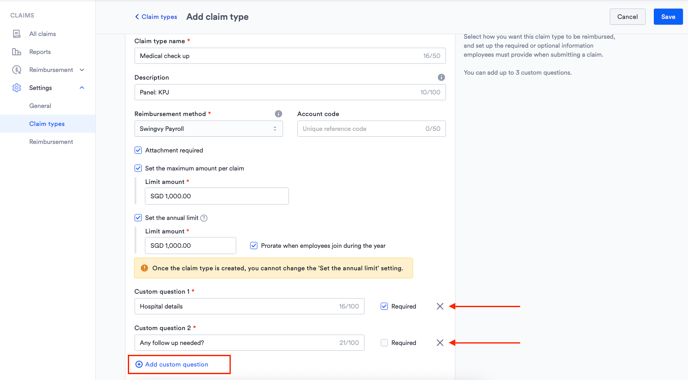

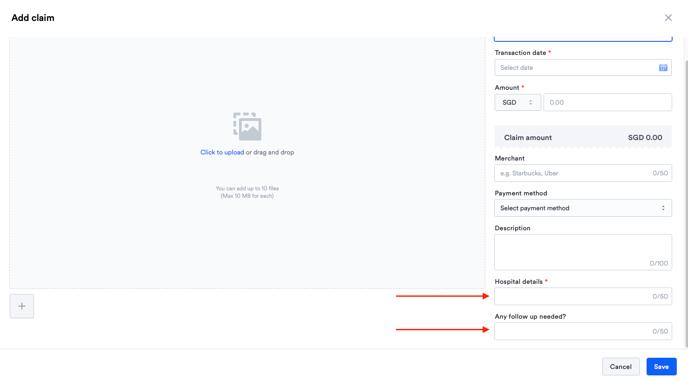

Add custom question

You can customise claim types by adding specific questions for employees to answer during claim submission. This feature is helpful for collecting additional details such as GST amount, receipt number, or project code.

You may enable the Mandatory option if the question must be answered before submission.

Admin's view:

Employee's view:

Managing claim types

Once the claim type is published, you still can manage it by edit or delete. However, once it has been deleted, it will no longer reflect on your users claim page.

Here is the step to edit or delete your claim type:

How to edit my claim type?

Once the claim is edited, all of the past reimbursement claims will also be affected.

How to delete my claim type?