Annual leave encashment

Leave Encashment is the amount of money an employee receives in exchange for the leaves not utilized from the paid leaves given by an organization in a year.

The amount to be paid for leave encashment is based on the employee’s base salary and the last day of work as the annual leave balance should be pro-rated accordingly. (Ministry of Manpower (MOM) outlines the annual leave eligibility and entitlement guidelines.)

However, as every company has a different leave policy when it comes to pro-rating annual leave, determine the number of working days based on the relevant policy. You may refer here for pro-rated salary calculations that suites your company policy.

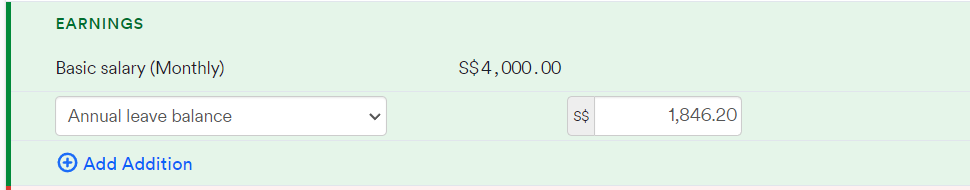

Add 'Annual leave balance' under "Earnings" on payroll

In the event an employee leaves the company, Swingvy will automatically prorate the remaining annual leave balance once the admin assigns an offboarding date. Based on the remaining balance, you can follow the steps below to process leave encashment:

Step 1 - Go to Payroll > Run payroll > Select relevant payroll and click on the affected employee

Step 2 - Under "Earnings", click "Add addition", and select 'Annual leave balance'

Step 3 - Manually calculate the daily rate of the resignee's base salary and multiply it by the remaining annual leave balance. Per the MOM, the formula to calculate a worker’s per day rate is [(12 x monthly basic rate of pay) / (52 x average number of days an employee is required to work in a week)].

Note:

When an employee resigns, the notice period is included when calculating pro-rated annual leave.

Example calculation:

Basic salary per month = S$ 4,000

Working days per week = 5 days

Unused leave = 10 days

Daily rate = (12 × 4,000) / (52 × 5) = S$ 184.62

Total encashment = S$ 184.62 x 10 days = S$ 1,846.20

Note:

Leave encashment is considered as part of additional wages and subject to both employer and employee’s CPF contribution if it falls within the AW ceiling.