Setting up payday and salary proration

Payroll > Payroll settings

On this page, you can set up the following information:

(a) Payday Information

Note:

The payday information is to define the monthly payday, the system will place this day in the payroll calendar to serve as a reminder

Setting up mid-month payroll in Swingvy Payroll

Activate the mid-month pay

Enable this function should you wish to pay your employee twice a month

Choose a mid-month pay date

The mid-month pay date is the date you would like to pay your employees, leave the default option as the 15th of the month or choose another if it varies.

The mid-month pay date is the date you would like to pay your employees, leave the default option as the 15th of the month or choose another if it varies.

Mid-month rate type

There are 2 options to choose from, by a fixed amount or by percentage.

There are 2 options to choose from, by a fixed amount or by percentage.

Mid-month rate

- If the percentage was selected, the employee mid-month advance will be the basic salary multiplied by the percentage

- If the amount was selected, the employee mid-month advance would be fixed at the amount defined in the settings

Compute statutory

With this option checked, the statutory for mid-month advance will be calculated during the mid-month payout. The mid-month statutory is only for reference purposes, the final statutory amount will be computed during the month-end payroll.

With this option checked, the statutory for mid-month advance will be calculated during the mid-month payout. The mid-month statutory is only for reference purposes, the final statutory amount will be computed during the month-end payroll.

Assignee

You may assign the employee with mid-month advance from the selection here or you may also include them in the employee profile.

You may assign the employee with mid-month advance from the selection here or you may also include them in the employee profile.

Go to employee profile, bank, and statutory and change the value in Pay Mid-Month to YES

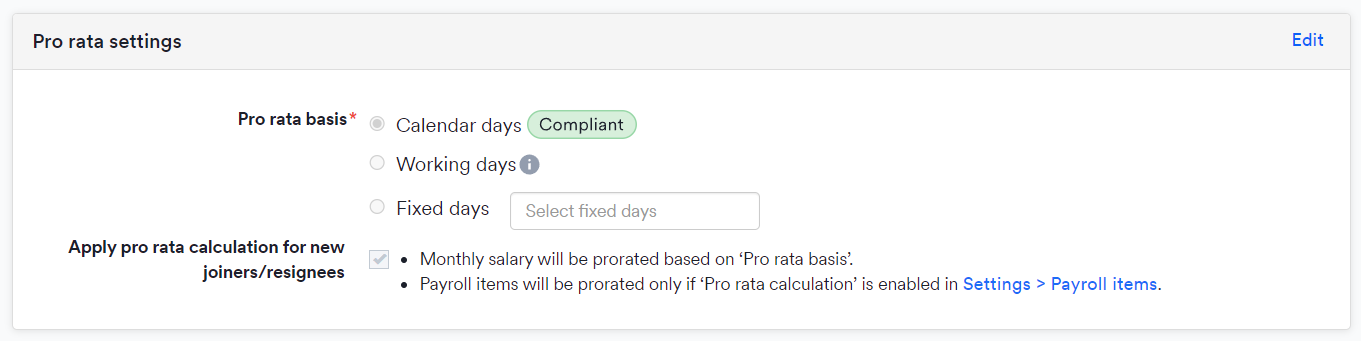

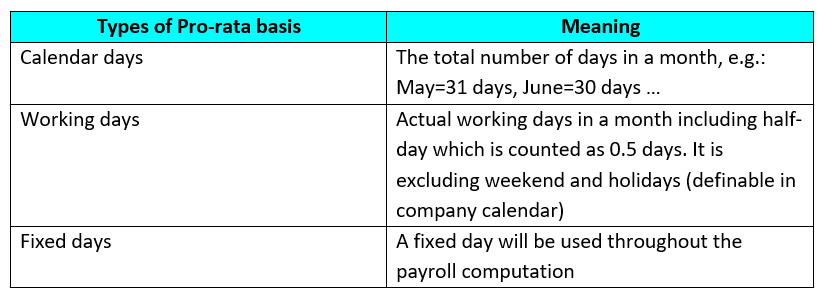

(b) Pro-rated Salary Calculation

This setting will enable salary proration for employees who join or resign during the payroll period. It is also able to be used should an employee have an unpaid leave. The prorate calculation of newly hired, resigned and unpaid leave is based on the type of days.

The computation of the prorated salary can be defined as below:

Note:

Following the amended Employment Act 1955 starting on 1st January 2023, (New section 18a – Calculation of Wages for Incomplete Month’s Work), Swingvy recommends setting the pro rata basis as "Calendar days".

(c) HRDF contribution

Under PSMB Acts, certain categories of employers are liable to pay a Human Resource Development levy for each working employee at the rate of 1.0% of the monthly wages of the employee.

Read more about HRDF here.