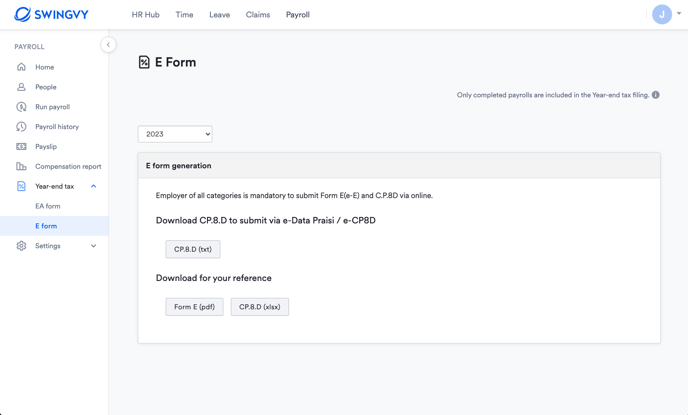

Generating E form

Form E is a declaration report submitted by every employer to inform the Inland Revenue Board of Malaysia (HASiL) on the number of employees and the list of employee's income details every year (no later than 31st March).

The group of employees who are applicable to Form E:

- The Company Director who received salary or fees

- Contract staff who received monthly remuneration

- Company’s permanent employees

- Foreign workers under the company permit

- Part-timers with EPF contribution

The group of employees who are not applicable to Form E:

- Sub-contractors

- Sole proprietors who received a salary

- Individual service provider/ self-employed individual

- External consultants

- Part-timers without EPF contribution

- Partners (in partnership) who received a salary

With Swingvy, the account admin has the option to either download the E form using preloaded data or fill it out online.

However, starting from 1st January 2024, the IRB of Malaysia (HASiL) will require the use of e-Services for all online transactions through the MyTax Portal service portal.

Consequently, employers or payroll admins must now submit their tax files online, as the submission via CD/USB Drive/External hard disk is no longer permitted.

Note:

- Select E-Filling to pay online via IRB

- Filling for manual submission or manual payment at the LHDN counter is no longer available from Year of Renumeration 2023

- Employers or payroll admins will still have the option to download xlsx and pdf files for reference purposes through Swingvy

To ensure a successful online filing submission, it is important to verify the accuracy of employees' information, including their employment status or employment type and the date of retirement or end of their contract.

Updating this information is simple and convenient. You can easily access the employees' profiles in the HR Hub by navigating to People > Directory > Select employees.

Note:

Ensure that the retirement date is updated correctly:

- For Malaysian full-time employees: The 60th birthday

- For resigned employees: Resignation/termination date

- For non-Malaysians, part-timers, interns, or contract workers: Contract end date

Learn more about E form submission here.