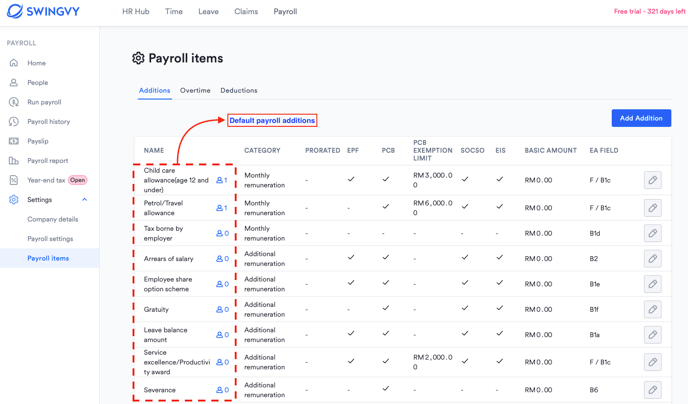

Payroll items - Additions

1. Default Addition

Note:

These standard addition items are created by default, and some cannot be edited.

Create your own customised Additions items if necessary. To make further changes to a payroll item, scroll down to No 2 - Customised Additions items to learn how.

However, these default Addition items can be edited in two circumstances:

- Updating the basic amount of additional items

- Select employee for monthly recurrence

2. Customised Addition items

Select this option only when you need to set up your customised Additions items.

Step 1 - Enter the new Addition name

Step 2 - If the Addition is unit base, select the checkbox and enter the per-unit amount

Step 3: If the addition is proratable for the new joiner/resignee, tick the box accordingly.

Step 3 - Select the statutory which will be subjected to this Addition

Step 4 - Choose employee

Step 5 - Finish this setup by clicking Save

Note:

The proration will only be calculated based on the proration setting that has been set in:

Payroll > Setting > Payroll Setting > Proration Setting

- It is only configurable only when ‘Apply pro-rata calculation for new joiners/resignees’ is ENABLED in ‘Payroll > Setting > Payroll setting > Proration setting’ (If not enabled, the checkbox is not visible)

- The calculation will be based on the ‘Pro-rata basis’ set in ‘Payroll > Setting > Payroll setting > Proration setting’.

Learn more about Addition items:

- Addition name - Enter a unique name for the new payroll item

-

Category – Click on the drop-down list for the below selection:

-

Monthly remuneration (normal monthly tax computation will be applied)

-

Additional remuneration (bonus tax computation will be applied)

-

-

Basic amount - The amount will be auto-generated every month for the selected employees. You can still edit the amount when running the payroll.

-

Calculate by unit – When you run payroll, you can calculate the amount by entering the ‘No. of unit’. (Formula: ‘Unit amount’ x 'No. of unit')

-

Statutory – Tick on the statutory attribute for this new item

-

EA form field – Select the EA form output column from the selection list

-

Select employee(s) for monthly recurrence - Apply to all or selected employees

Note:

In Malaysia payroll, certain payroll items come with a tax exemption limit based on regulatory guidelines. Currently, there are three default payroll items in Swingvy that include tax exemption limits. Learn more here.