Submitting E Form via MyTax Portal

It is essential for every employer and company, regardless of whether they have employees, to submit Form E to LHDN. Neglecting to do so may lead to LHDN taking action against the directors of the company.

All companies and employers are required to submit Form E by the deadline of 31 March.

To ensure that your filing is complete, it is necessary to submit both Form E and CP8D, which is the statement of employees’ remuneration and deductions.

How to submit Form E via e-Filing?

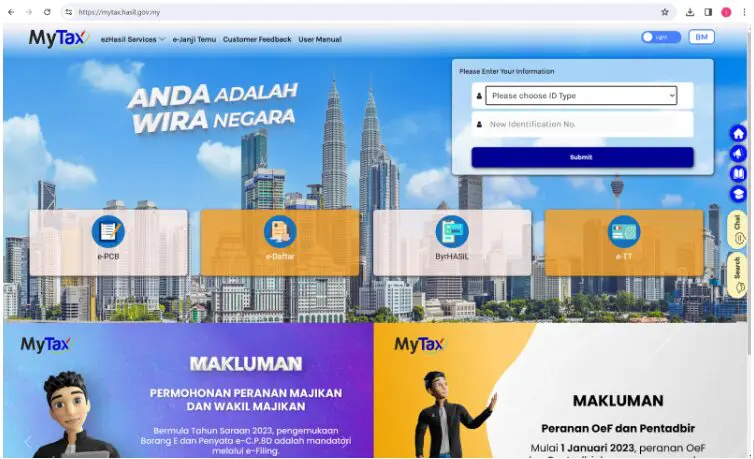

1. Go to the MyTax portal

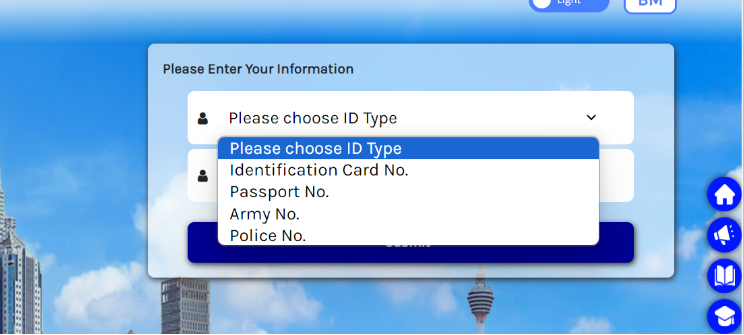

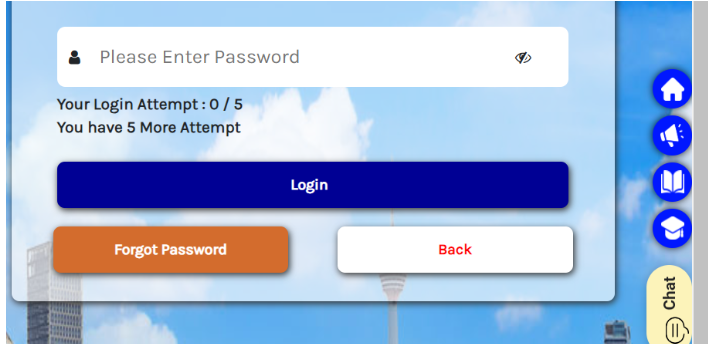

2. Log in by choosing your ID Type and entering your ID number and password

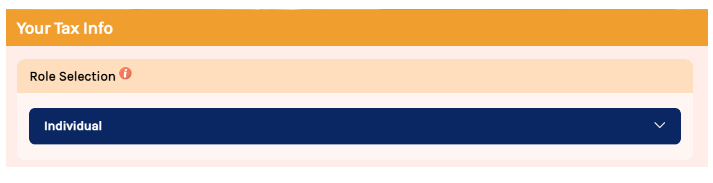

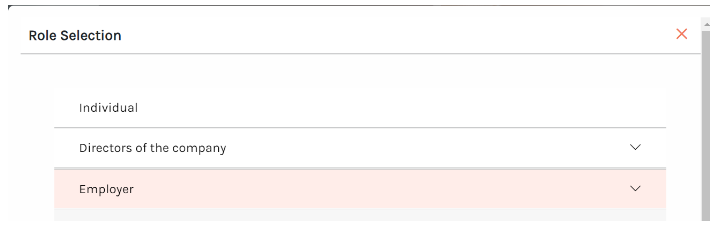

3. After logging in, navigate to the Role Selection dropdown menu. Here, you should choose either Employer or Employer Representative. Next, select the name of the business or company for which you intend to submit the E form. If you do not see either role listed, please consult this article for guidance on how to apply.

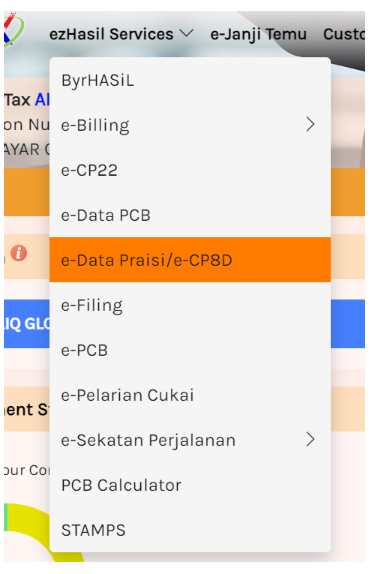

4. Then, go to the EzHasil Services menu and select e-Data Praisi/e-CP8D

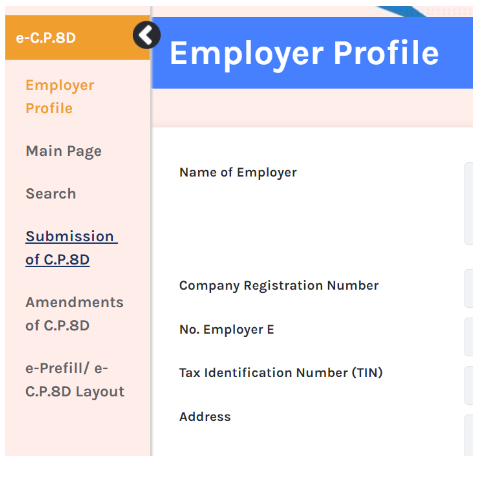

5. Click on Submission of CP8D

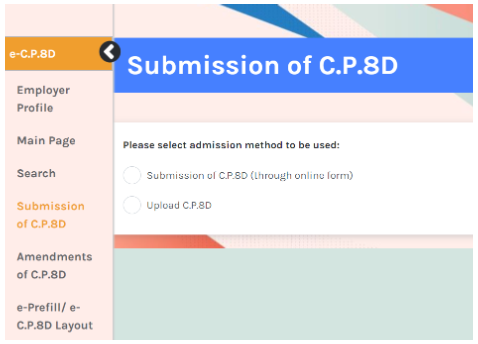

6. You may choose Submission of CP8D (through online form) to enter your employees' details directly into the online form, or alternatively, you can conveniently choose Upload CP8D to upload the CP8D text file generated from Swingvy.

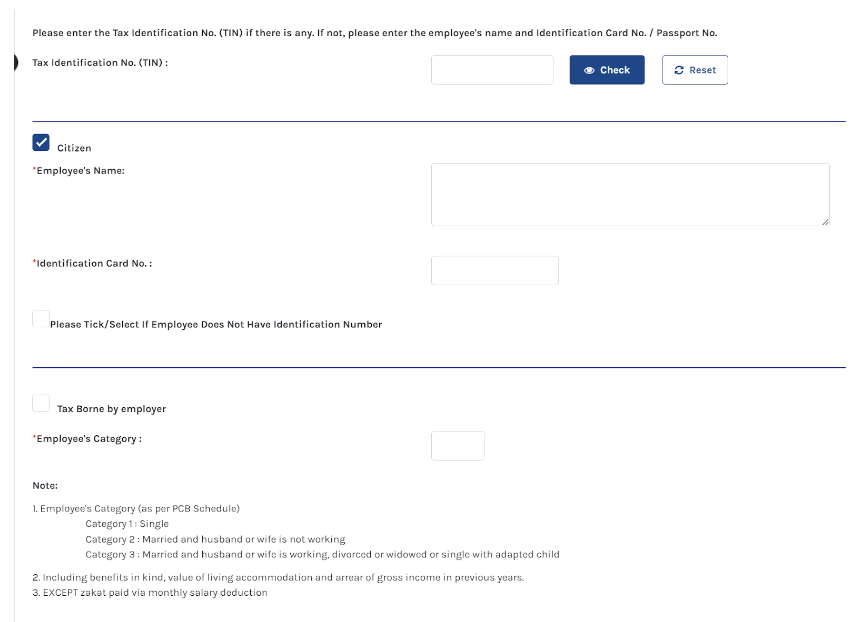

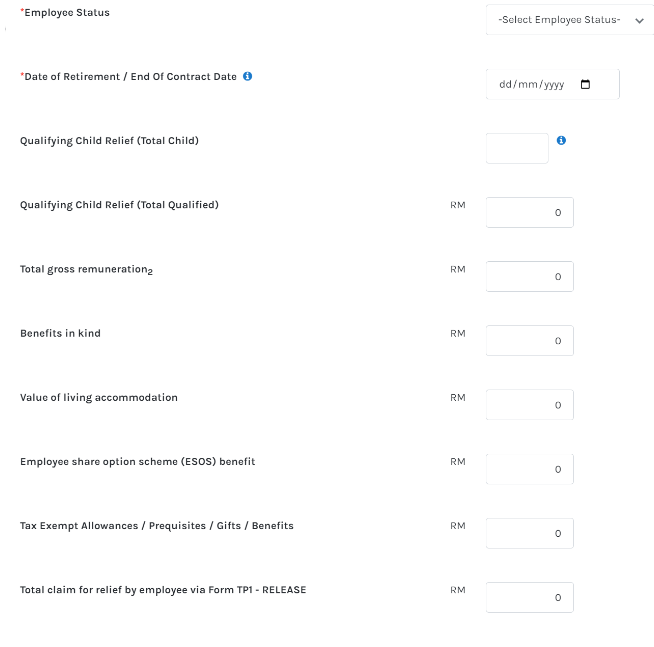

6 (a). If you opt for the Submission of CP8D (through online form), it is important to accurately enter all required personal and remuneration details for each of your employees, as illustrated in the following sections.

6 (b). If you choose to use the Upload CP8D option, you can conveniently upload the CP8D text file generated by Swingvy (.txt). This file includes all necessary personal and remuneration details of your employees, eliminating the need for you to manually enter each detail one by one in the online form.

7. After uploading, the remuneration details for your employees will be presented for your review, allowing you to verify their accuracy.

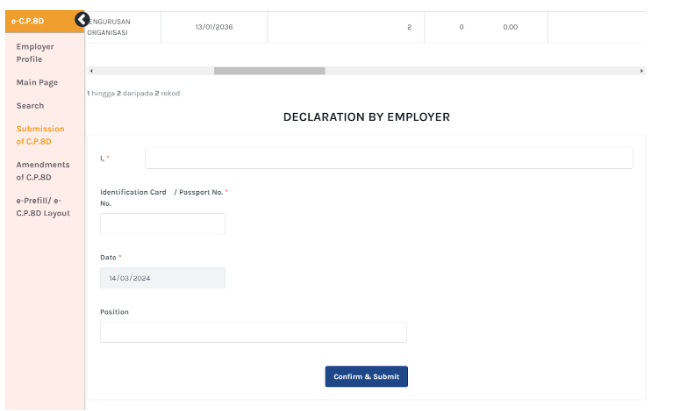

8. After verifying the accuracy of the details, please proceed by clicking on Confirm & Submit.

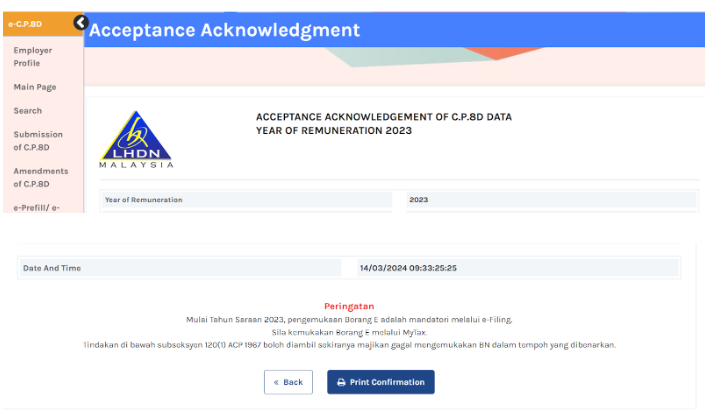

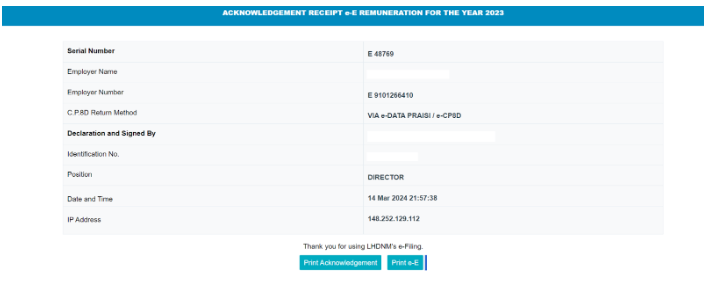

9. Upon successful submission of your CP8D, you will receive an acknowledgment. This acknowledgment can be printed or downloaded by selecting the Print Confirmation option.

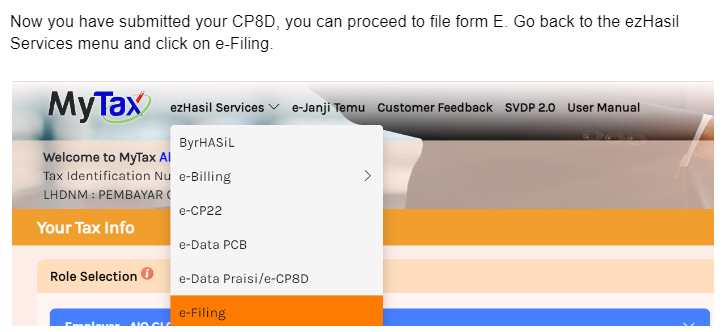

10. At this point, having successfully submitted your CP8D, you are ready to move on to filing Form E. To do so, return to the ezHasil Services menu and select the e-Filing option.

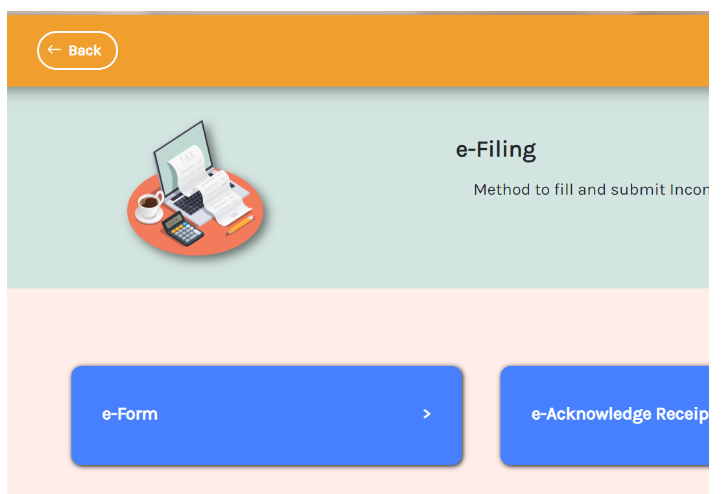

11. Click on e-Form

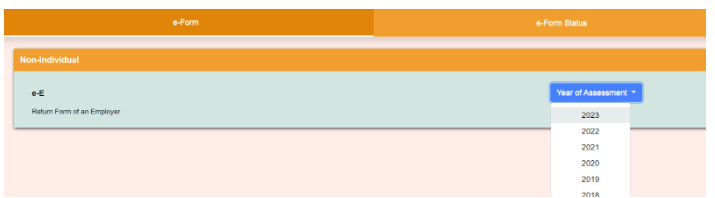

12. Select the year of assessment

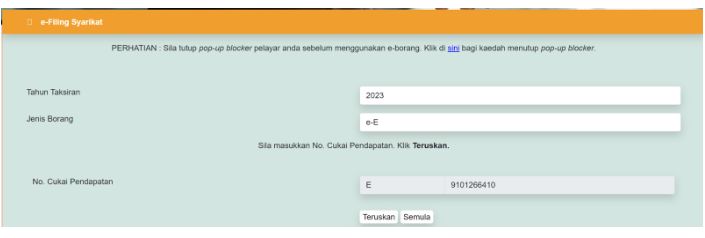

13. Click on Teruskan

14. The form will automatically switch to Bahasa Melayu, however, you can easily revert to English by clicking on the "EN" option located at the top right corner of the page.

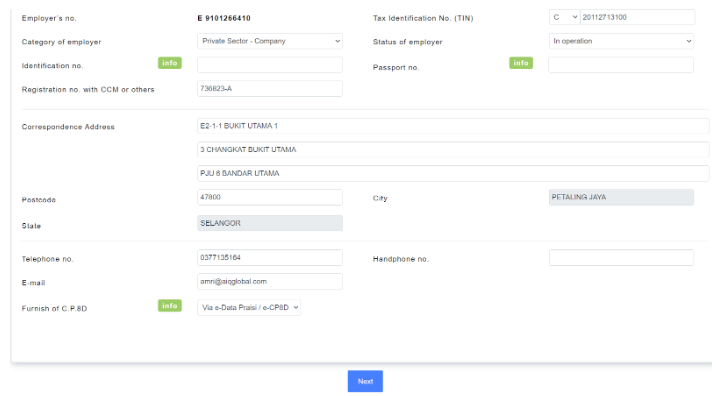

15. Please ensure that all necessary company details are accurately completed before proceeding by clicking on Next.

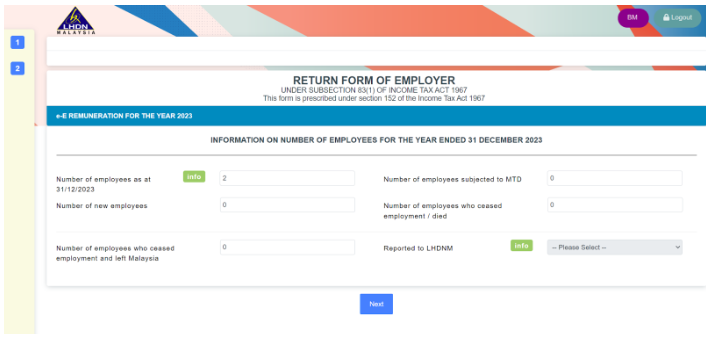

16. Please provide the details regarding the number of employees at the year-end, including figures for new hires and those who have departed during the year, as well as the count of employees subject to PCB. To assist you, you may refer to the E form PDF generated by Swingvy, which conveniently compiles these figures for your ease of reference.

17. Click on Next

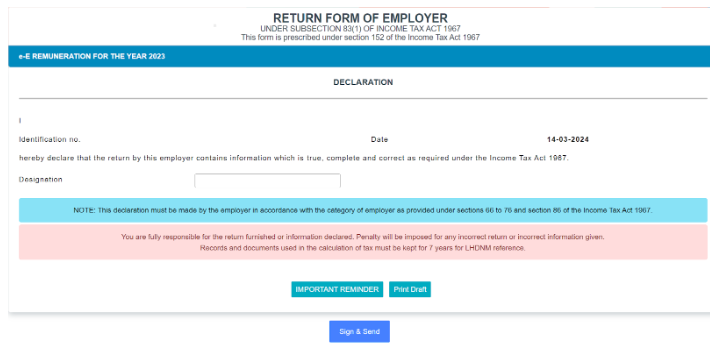

18. Finally enter your designation and click on Sign & Send

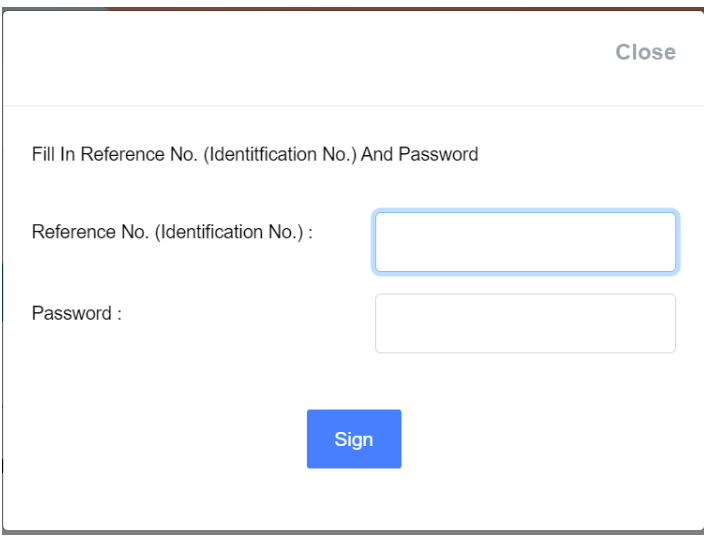

19. To sign, enter your ID number and MyTax password

20. You will receive a confirmation of your Form E submission, and you will have the option to download both the confirmation and the e-E document for your records.

21. Congratulations! You have successfully completed the submission of the E form.