How to run payroll?

Step 1 - Click Payroll from the top Menu bar

Step 2 - Click Run payroll from the menu to start your payroll

Step 3 - Select the payroll period and payroll type

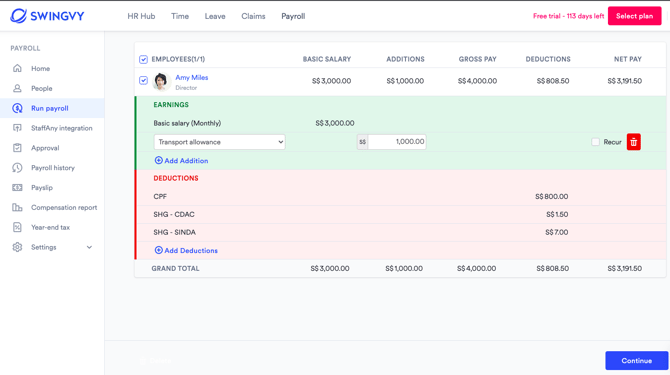

Step 1 - Adjust payroll

- To add addition payroll item - Click on the Add Earning button and select the new item from the master list.

- To remove the payroll item from the particular month of payroll - Click on the delete button next to it.

Note:

-

If the item is a fixed allowance and you delete it from the current month's payroll, it will be removed in the following month's payroll as well unless you add it back.

-

The statutory computation will auto-calculate once you change the amount of any payroll items which are subjected to CPF & SHG-CDAC. Click on Save & Review to move on to the next step.

On the other hand, you can also adjust all the payroll items by using a bulk update file. You can click on the 'Bulk update' button and download the file. All the listed payroll items will be visible in an excel file and you can edit the figure of the payroll item accordingly. You can check the instruction from the downloaded excel file.

.png?width=670&name=image%20(4).png)

After all payroll item is edited accordingly, you can save the file and upload the file back to Swingvy. The figure will be reflected.

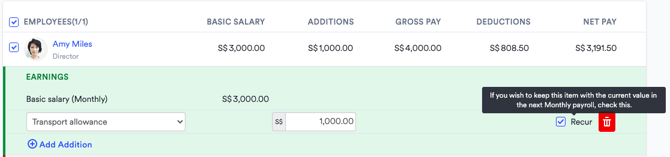

Tip: Recur Payroll Items

You can now set payroll items to recur in the following month, with the ability to set differing amounts by employee.

If you wish to keep the payroll item with the current value in the next Monthly payroll, you may check on the Recur box next to it.

Step 2 - Review and confirm

Click on Continue and Confirm for finalization.

If you've enabled Payroll Approval settings, you can only proceed once your payroll approver has approved your payroll.

Note:

-

Click “Back to Step 1” if you need to return and adjust your payroll.

-

If payroll has been requested for approval but is still pending:

The “Back to Step 1” button will be unavailable. In this case, the approver must decline the payroll first, which will revert it back to Step 1 for amendments.

-

If payroll has already been approved by the approver:

The “Back to Step 1” button will also be unavailable. You will need to click “Confirm Payroll” to proceed to Step 3, then click “Revert to Adjust Payroll”to go back to Step 1 for amendments.

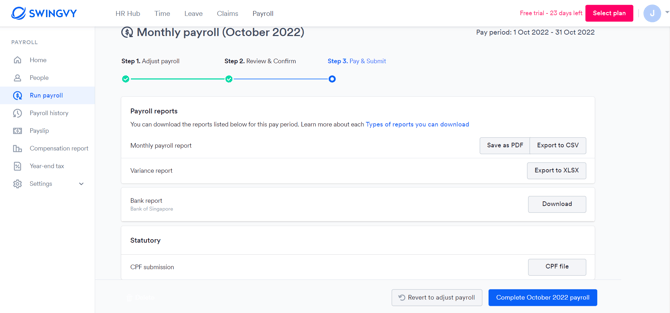

Step 3 - Pay and submit

- Export bank file

- Export statutory reports

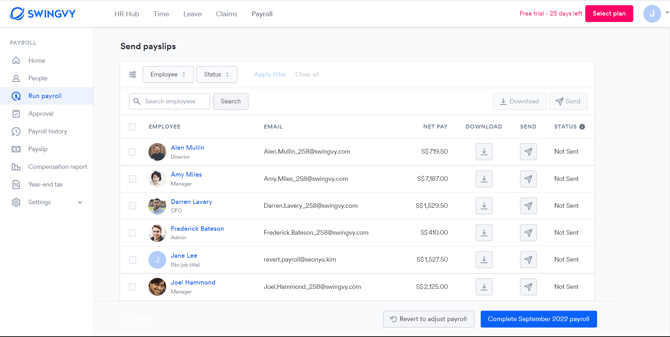

- Send payslips to employees

Step 4 - Complete month payroll

Once all the payroll reports are exported and payslips are sent out to the employees, you would need to proceed to complete the payroll in order to store the data. Then, you will have access to payroll history in the “Payroll history” menu.

Notes:

1. All past payrolls must be completed to ensure correct statutory calculations. Payrolls currently in step 3 are not considered completed.

2. Each payroll needs to be completed because only completed payrolls are included in the Payroll history, Compensation report, Payslip page, and Year-end tax filing.

3. Any Ad hoc/Mid-month payroll in the same month will be completed along with the Monthly payroll.

See also: